Cebra

Zoom video communication (NASDAQ:ZM) initially soared after its February earnings report, as the company announced strong results and approved a large share buyback program.Management still appears to be looking for M&A opportunities, but share buybacks are still on the horizon. This program could have been seen as a real catalyst for undervalued tech stocks. ZM surprisingly gave up all post-revenue profits and more, giving investors another chance to invest in the name. Growth is unlikely to excite investors any time soon, but even if it does, its low valuation, net cash balance sheet, and high profit margins continue to make it an attractive stock. I reiterate my buy rating on this stock.

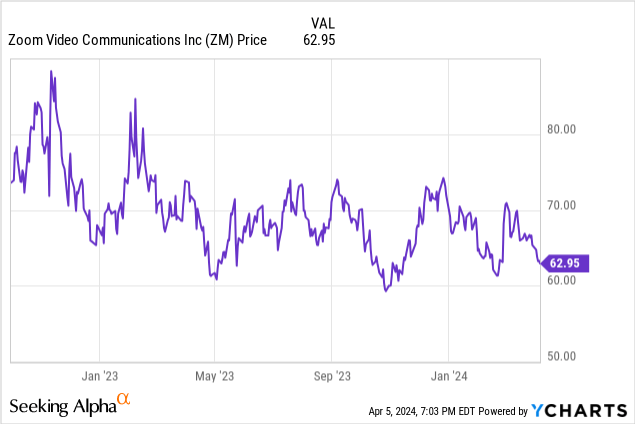

ZM stock price

I last covered ZM in January, when I rated the stock a buy, called it a potential acquisition target, and highlighted the following: Net cash accounts for 30% of market capitalization. Since then, the stock has underperformed the broader market by about 20%.

My bullish case remains valid, and management has provided further stimulus by restarting the share buyback program.

Main indicators of ZM stock

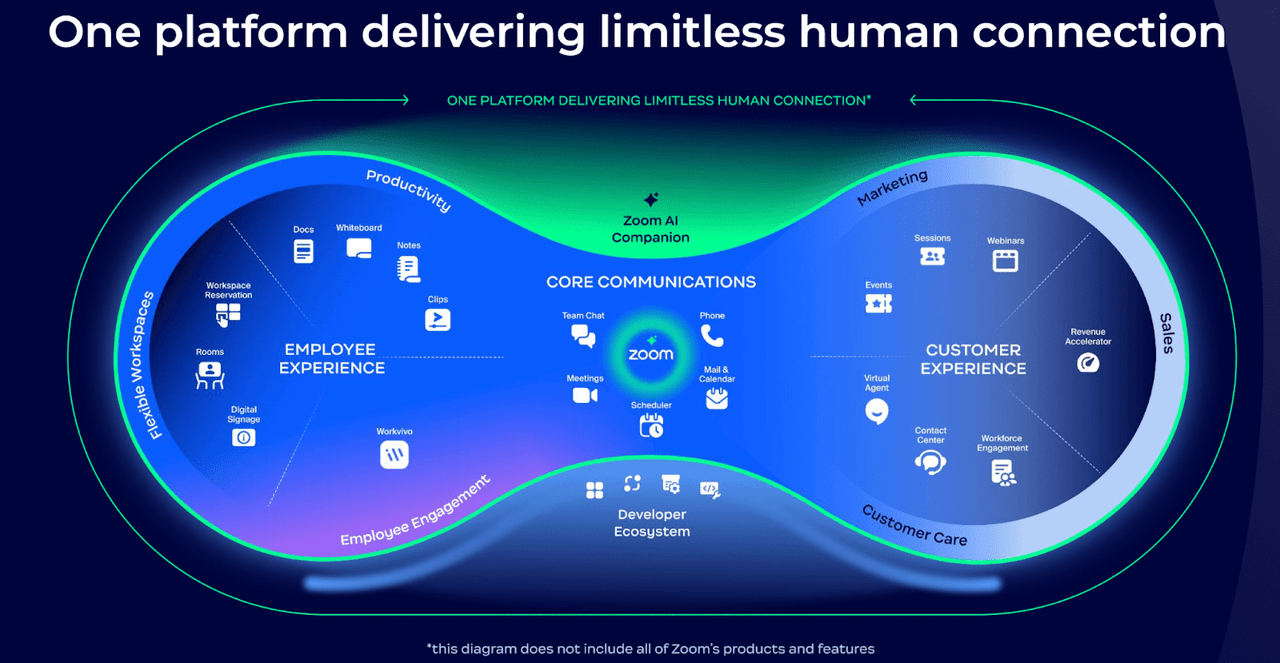

ZM has become a household name post-pandemic thanks to its video conferencing products. Although videoconferencing remains its main business area, the company also offers other workplace communication solutions as well as contact center products. Post-pandemic, the company's growth rate has struggled due to both aggressive growth acceleration during the pandemic and continued chartering of online services.

2024 Q4 Presentation

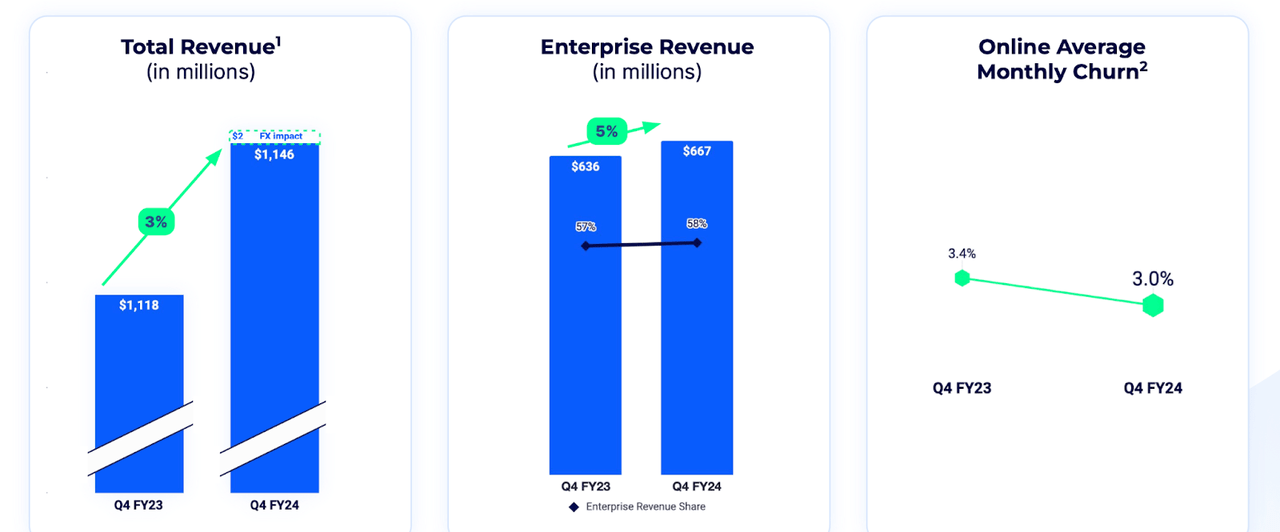

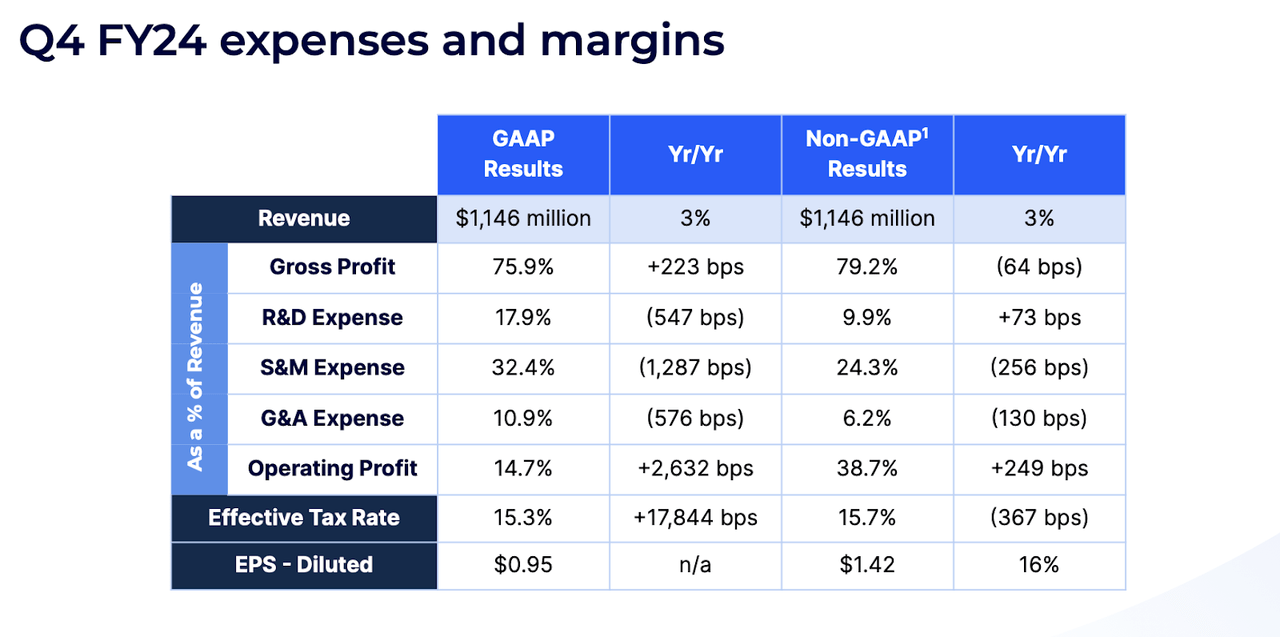

This past quarter, ZM saw revenue increase 3% year-over-year to $1.1 billion, narrowly exceeding guidance of up to $1.13 billion. I think many investors are disappointed by the slowdown in corporate earnings growth, but I want to emphasize that the online monthly churn rate was 3%, the same as in the third quarter. During the conference call, management noted that the second and fourth quarters typically experience seasonally higher churn rates, so a stabilization thereafter could be more pronounced.

2024 Q4 Presentation

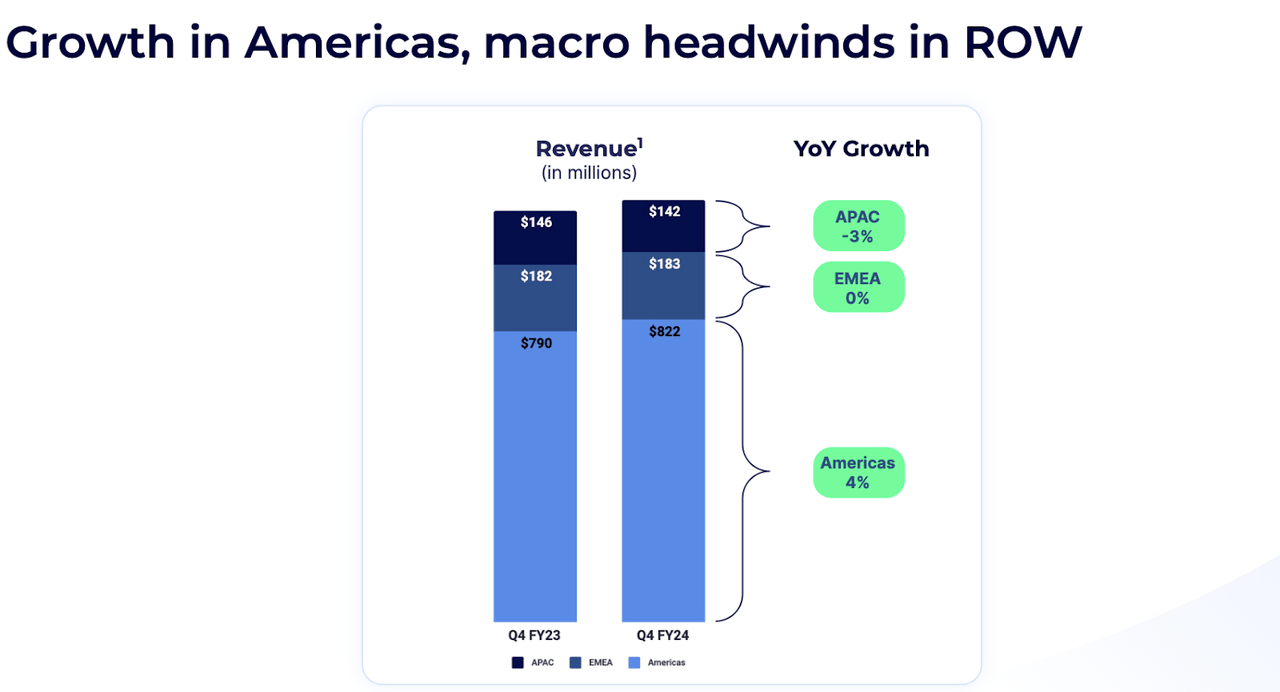

This is also a potential bullish data point, as ZM has the highest growth rate in the Americas and could see stronger growth in EMEA and APAC as geopolitical tensions ease. There is a possibility that

2024 Q4 Presentation

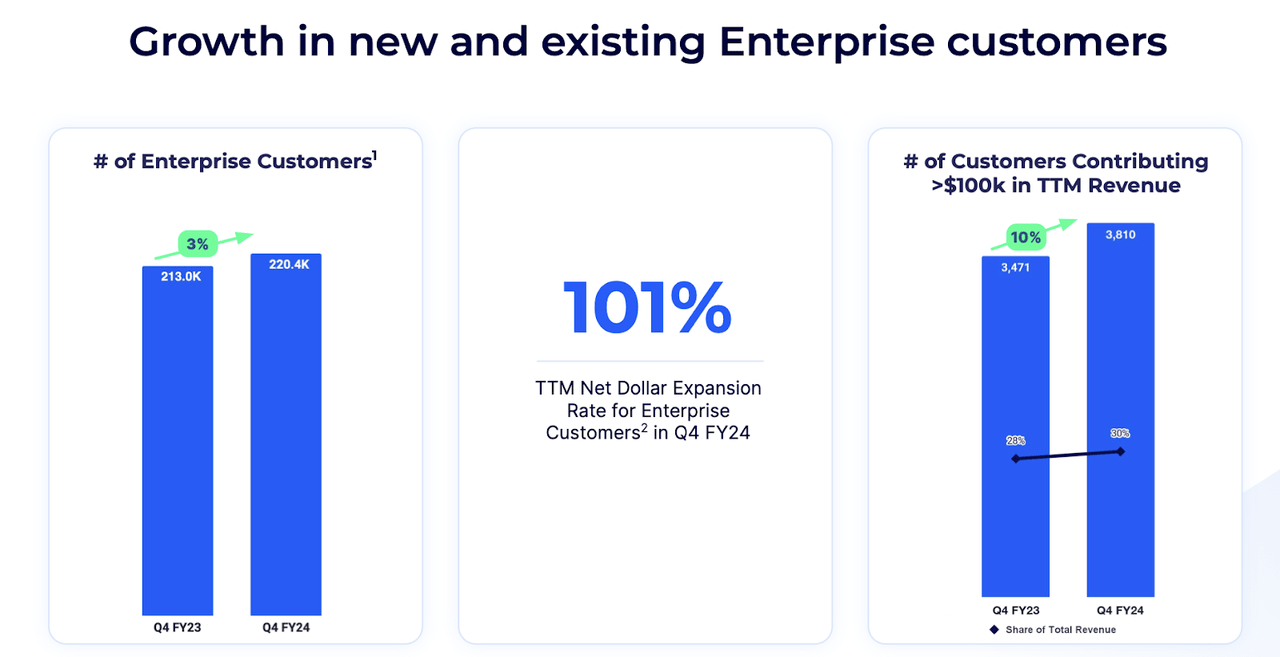

ZM confirmed that TTM net dollar expansion for enterprise customers continued to slow to 101% from 105% in the third quarter. Management said it is working on a major renovation, which could ease next year.

2024 Q4 Presentation

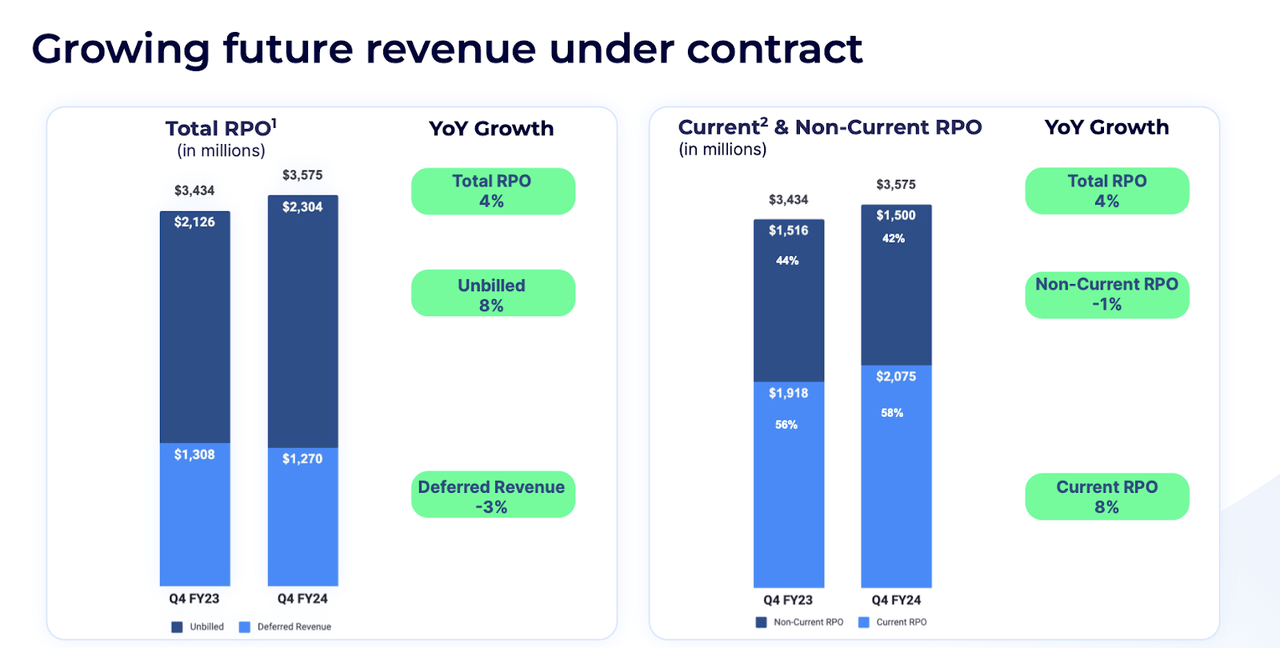

ZM has experienced steady growth in remaining performance obligations (“RPO”), as evidenced by an 8% increase in cRPO. Investors often view cRPO as a leading indicator of future revenue growth.

2024 Q4 Presentation

Although sales growth slowed, the company demonstrated operating leverage, particularly in S&M and G&A, resulting in non-GAAP EPS growth of 16% year over year.

2024 Q4 Presentation

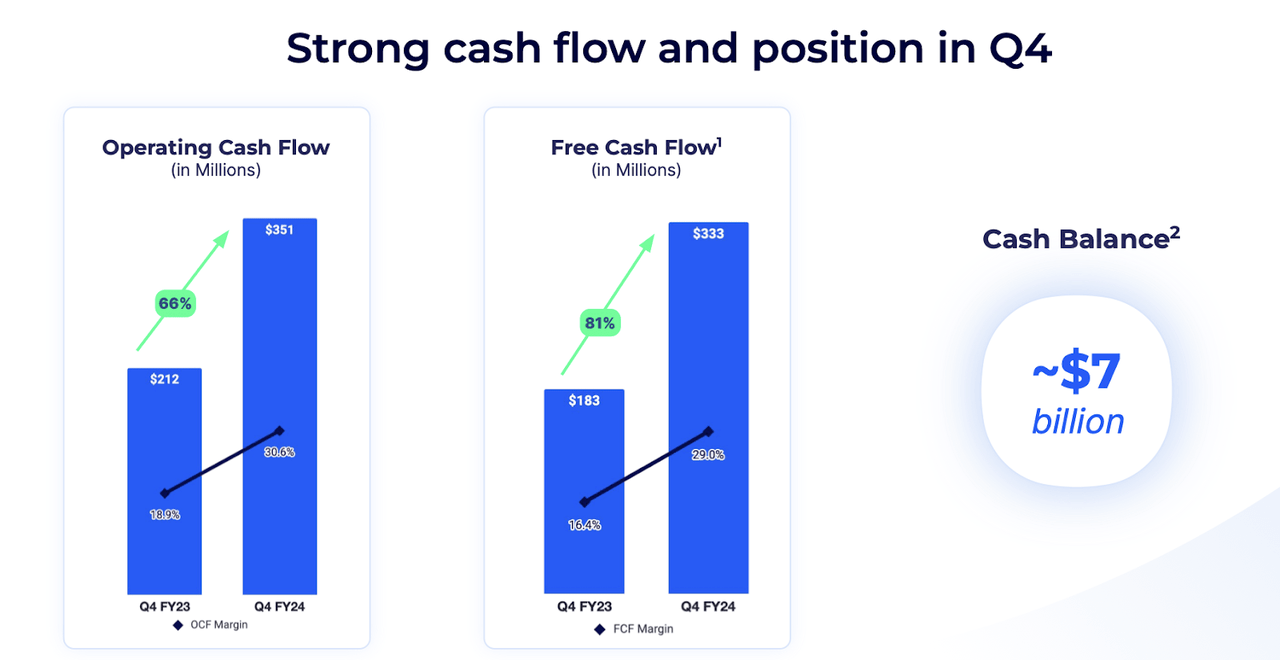

ZM ended the quarter with $7 billion in net cash versus debt-free, indicating a healthy balance sheet (and a key part of the bullish thesis).

2024 Q4 Presentation

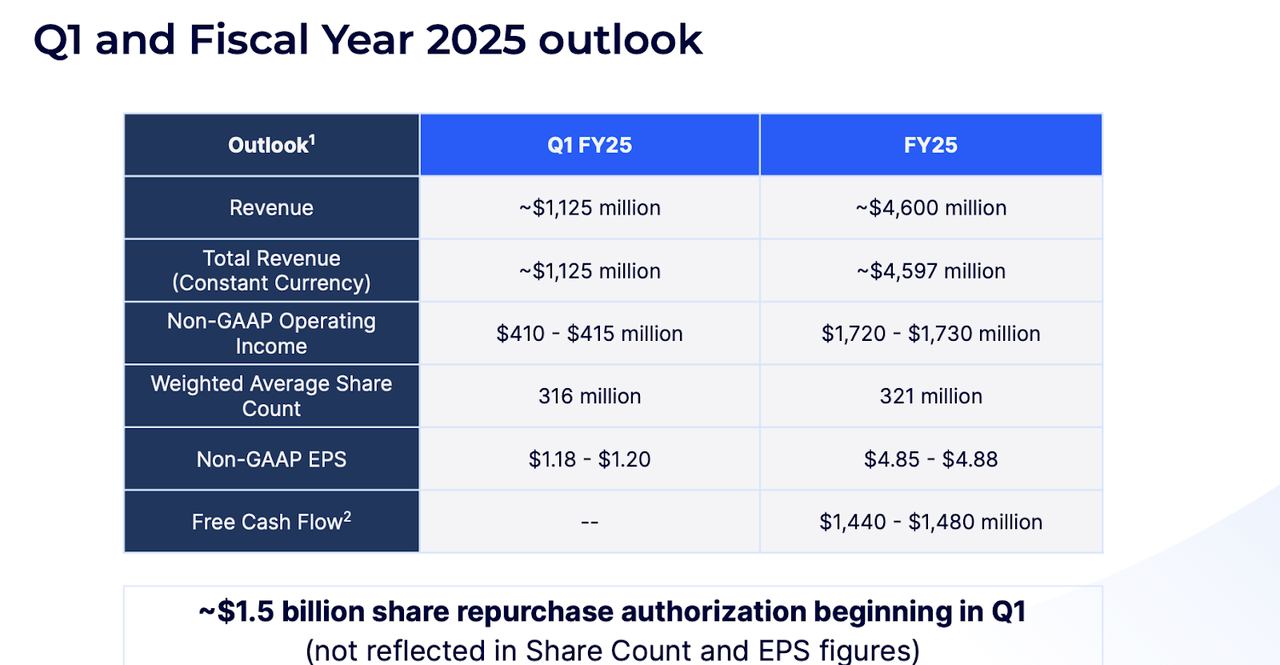

Looking ahead, management is calling for first-quarter revenue of $1.125 billion (versus consensus estimate of $1.13 billion), representing 4.8% year-over-year growth, and full-year revenue of $4.6 billion, compared with the prior year. This is expected to be equivalent to 1.6% growth compared to the previous fiscal year.

2024 Q4 Presentation

It's worth noting that management has also approved a $1.5 billion share repurchase program, which they say “will allow us to leverage our strong profitability, cash flow and balance sheet to drive shareholder returns while We are accelerating our growth and delivering it to our customers.'' Management noted that sales growth is likely to bottom out in the second quarter and accelerate from there sequentially throughout the year. That said, as analysts aptly pointed out on the conference call, given that the company should probably benefit from new products like phones and contact centers, as well as other products that leverage AI. , this guidance is puzzling, but it doesn't seem to reflect the low full-year revenue growth outlook. At this stage, it is unclear whether management is simply being overly conservative with guidance, or whether core product delivery is experiencing larger than expected problems (explained by continued update activity). ).

Buy, sell or hold ZM stock?

Like all tech stocks these days, ZM is an AI stock, even if generative AI isn't yet fueling revenue growth. ZM has integrated generative AI into a variety of products, especially virtual agents, which are a key feature in contact center products. Management said on the conference call that implementing Virtual Agent within the company has saved “400,000 hours of agent time” each month. Management believes it is “starting to win in direct competition with traditional incumbents” with its contact center products.

Zoom virtual agent

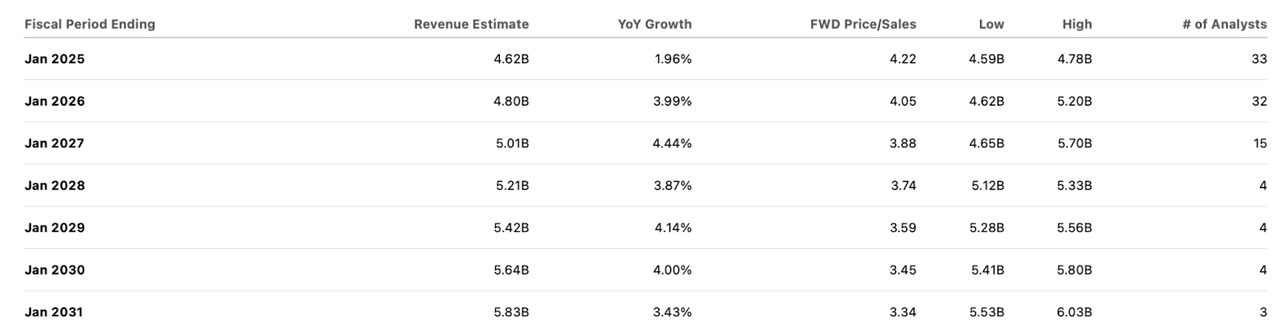

Based on management guidance, this development is not expected to be a catalyst for accelerating revenue growth at a consolidated level, at least in the near term. However, it's important to note that competitor Microsoft (MSFT) is unbundling its Teams and Office products due to regulatory influence. Perhaps the problem that ZM has been facing for a long time is competition from Microsoft Teams. Here's the problem. ZM has (in my opinion) a technically superior video conferencing product. However, the past few years since the pandemic have revealed the painful reality that customers are okay with “good enough” as long as the price is right. Nor should we underestimate the power of MSFT's name brand or the perception (or reality) that the company is at the forefront of generative AI adoption. Separating Microsoft Teams from other products could allow ZM to compete on a more “level” playing field. My personal view is that while there may be some impact, investors should not expect the impact to be in the order of 500 bps. The consensus forecast appears to be in line with that view, as analysts expect ZM to generate low-single-digit revenue growth over the next few years.

In search of alpha

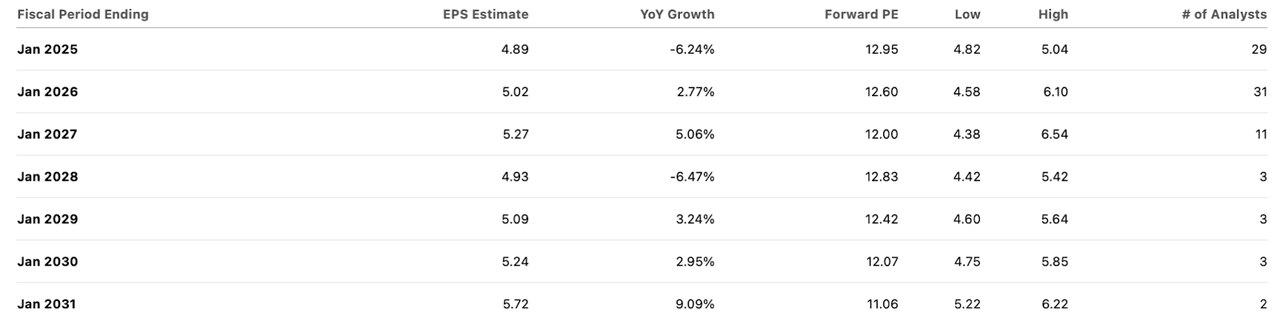

Admittedly, this growth rate is not attractive to its peers, but I would argue that this growth rate is sufficient when the company trades at 13 times non-GAAP earnings.

In search of alpha

Stock-based compensation certainly needs to be taken into account, accounting for 67% of GAAP net income in the past year. However, we note that this is an improvement from 98% a year ago, and two years ago it posted a better figure of 33% (which means that for the financial year ending January 2022, the company GAAP net profit margin is 33.5%). The surge in stock compensation is largely due to the surge in headcount during the pandemic, so it's not likely to decline any time soon. That being said, I typically value these tech stocks based on estimates of their long-term profit potential. We believe that is more realistic than applying recurring income, which can be suppressed by investments in growth and ultimately skyrocketed by operating leverage. . I suspect that due to the nature of ZM's products (and the margins posted during the pandemic), the company will likely be able to achieve 40% net margins, if not more, in the long term. . We do not apply a non-GAAP return rate (currently 7.7%) in calculating potential total returns to account for the fact that we are not currently generating those margins. However, it is still appropriate to use long-term margin assumptions for calculations. Possible return from multiple expansions. To apply some safety margin, we assume a long-term net margin of 35%. Based on a sales multiple of 4.2x, the company's long-term profit is 12x. I continue to expect a price-to-earnings ratio of ~15x to 18x, suggesting that multiple expansions alone could generate returns of 25% to 50%. This valuation appears justified given its strong balance sheet and repeatability of its business model. Investors may be concerned that the current single-digit top-line growth rate could eventually turn negative, so the main factor driving the stock closer to its valuation is investors' appreciation of the business model. This may be due to an increase in trust. However, it should be noted that some of the company's growth slowdown appears to be macro-driven. In addition to many customers undergoing layoffs or headcount growth freezes, many customers may also be undergoing “data controls” such as not keeping records. Many video conferences. Both of these factors will have a negative impact on net retention, but ultimately the company will overcome these headwinds, at which point it will become more comparable, and an improving macro environment could reverse these trends. There is also. I don't think these two headwinds need to be reversed to maintain single-digit sales growth per consensus estimates. We see this as being driven by the ongoing digital transformation.

Note that net cash makes up 35% of the market capitalization and is not directly factored into the calculation of total return potential. This is because management appears to be aiming to use some of its net cash toward acquisitions, which may not be as revenue accretive as share buybacks. However, some smart acquisitions could strengthen ZM's platform and address both its competitiveness and valuation gap with MSFT. I decided not to consider this possibility because the acquisition target and its implications are not clear. These represent “weights” compared to my calculated earning potential.

What are the key risks? The first risk is that ZM will not achieve my target 35%-40% net profit margin assumption. ZM may need to discount its products to retain business from competitors, which could impact both the unit level and operating margins. While there is still a risk that growth stock profitability assumptions may change, my hunch remains that ZM is the type of business that can achieve higher returns in private equity operations (just one example). My rating there is primarily due to the lack of innovation required for video conferencing, which ironically may indicate the potential for greater benefits. Another risk is that competition will increase, at which point ZM will not be able to benefit from digital transformation. Investors may be underestimating the risks of business execution. As mentioned earlier, the company generated his GAAP net margin of 33.5% during the pandemic, but GAAP margins have shrunk significantly since then as management worked to reaccelerate growth. Management can take these efforts too far and end up with a cost structure that cannot be easily reversed.

conclusion

ZM continues to generate solid profit margins and show some sales growth. A new share buyback program could be the start of a re-rating of the stock. I reiterate my buy rating on the stock, as its low valuation, high profitability, and continued share buybacks make ZM a unique value stock in the tech sector.