CYCLONEPROJECT/iStock via Getty Images

I am bullish on value over growth and mid-cap over large cap. Why? Because the cycle still exists. The market dominated by growth and tech stocks has mostly favored large caps. At some point it will end and a rotation will begin. That is, Vanguard Mid Cap Value Index Fund ETF Shares (NYSEARCA:VOE) is worth considering. It's a passively managed exchange-traded fund (ETF) that replicates the CRSP US Mid Cap Value Index. The fund has low costs (a 0.07% expense ratio) and has over $28 billion in net assets.

VOE's portfolio adheres to a perfect replication strategy, maintaining a similar percentage allocation to each constituent of the underlying index (in this case, 196 mid-cap value stocks). VOE's investment process incorporates value-oriented factors such as low price-to-book and price-to-earnings multiples, high dividend yields, and strong sales. metric.

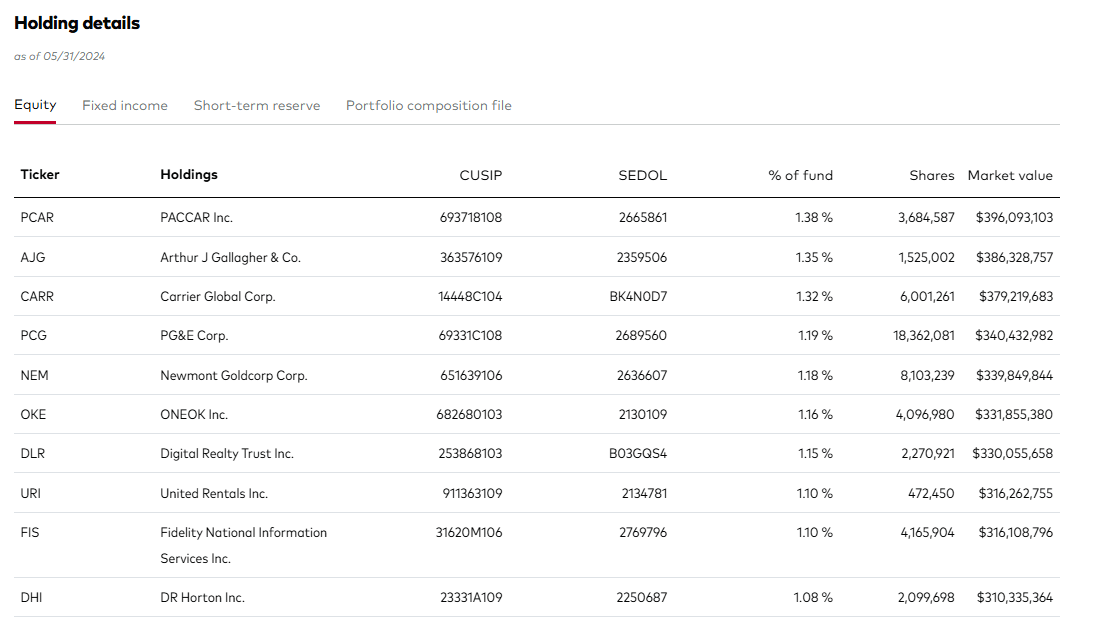

Overview of assets held

One of the big things I appreciate about this fund is its diversification. No position in it is more than 1.38% of the portfolio. This is very important given how concentrated it is in the large cap average in terms of its top holdings, meaning that a diversified index has a lot more concentration risk than most people realize.

Vanguard

What are these positions? PACCAR Inc (PCAR) is a leading manufacturer of light, medium and heavy trucks under the Kenworth, Peterbilt and DAF brand names. Arthur J. Gallagher & Co. (AJG) is a risk management services company for the insurance industry. Carrier Global Corp. (CARR) is a global provider of heating, ventilation, air conditioning, refrigeration and fire and security solutions. PG&E Corp distributes electricity and natural gas in California. And Newmont (NEM) is the world's largest gold mining company with extensive operations in the Americas, Australia and Ghana. The key here is that the holdings span every industry.

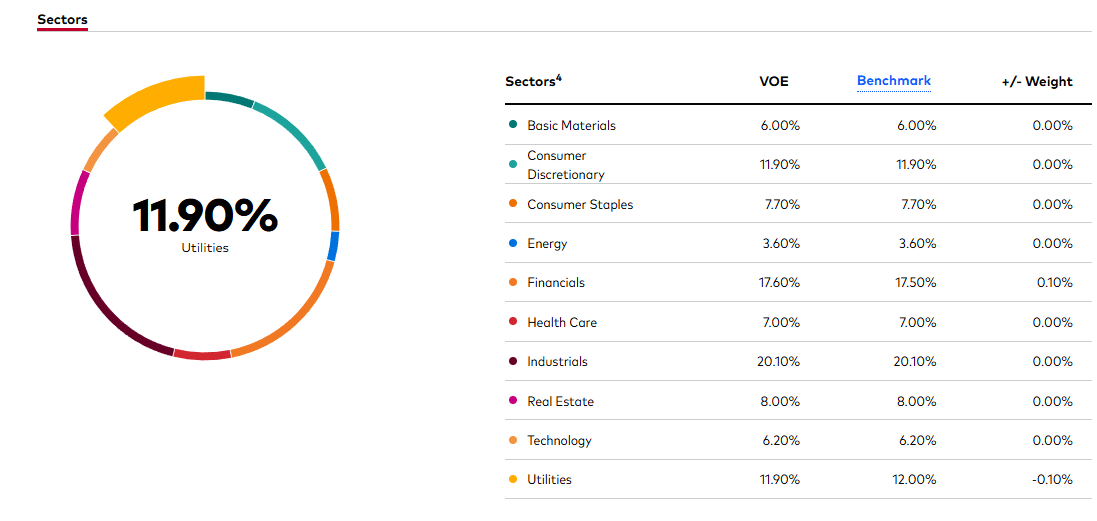

In terms of sector allocation, industrials, financials, utilities, and consumer discretionary are the largest holdings. I like that utilities make up 11.9% and technology only accounts for 6.20%.

Vanguard

The difference in technology exposure is where this fund will make a big difference and outperform. We all know that technology is driving this bull market with a few select AI stocks (mainly Nvidia and Microsoft) driving the headline averages higher. I have argued several times that if AI is real, then all companies should benefit from the productivity gains that AI will bring to their operations, which will lead to higher profit margins. Obviously we are not there yet, but it is coming. And when it does, mid-caps (and I would argue small caps as well) should benefit and see unexpected earnings growth for years to come.

Comparative Analysis

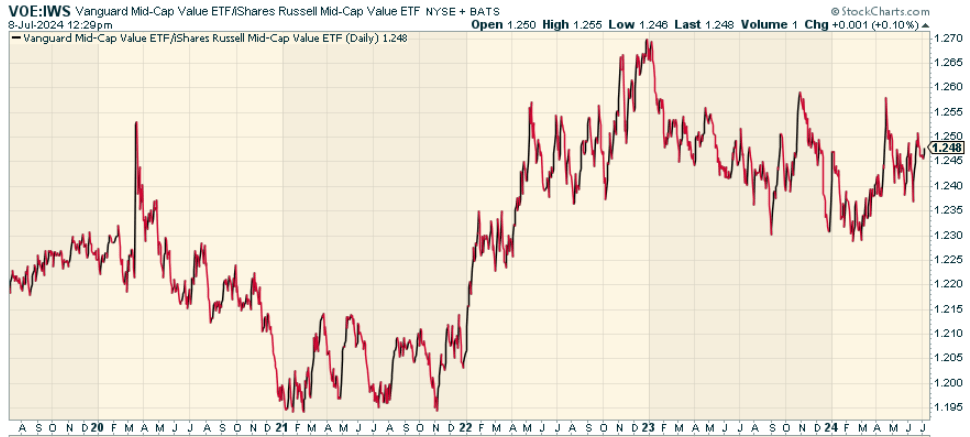

Obviously, there are a lot of competitors here. One fund worth comparing is the iShares Russell Mid-Cap Value ETF (IWS), which has a more expensive expense ratio of 0.23%. Looking at the price ratio of VOE to IWS, the two funds have performed roughly equally since 2022. Since 2019, VOE has performed better overall, but we don't see a clear advantage.

Stock Chart

Pros and Cons

From my perspective, the key here is diversification and style. Historically, mid-cap US value stocks have outperformed large-cap US growth stocks. Believe it or not, mid-cap value stocks should be able to enjoy the benefit of selling at lower valuations than large growth stocks while robust growth drives strong earnings and sales growth.

But mid-cap value investing is not for the faint of heart: Because these stocks have smaller market capitalizations, they can be more volatile than their large cap counterparts, and value strategies can experience extended periods of underperformance when the market gets overexcited and growth stocks are demanding high prices (as is the case now).

Conclusion

I think this is a good fund and a good place to invest. VOE offers cheap and easy exposure to mid-cap value stocks and if you are relatively passive on large caps and technology this fund makes sense as a core position. Just keep in mind that the cycle is still clearly favoring large cap growth. I don't think it will last much longer.

Get the Lead-Lag Report for 50% off

Get the Lead-Lag Report for 50% off

Are you tired of being a passive investor and ready to take control of your financial future? Introducing the Lead-Lag Report, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off with ease and confidence. For a limited time, get 50% off by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.