According to French novelist Anatole France, one can never be happy unless one sacrifices ignorance. This phrase may explain today's market. Those who are bullish and only care about their own interests are probably satisfied. But scratch just a little beneath the surface of the bull market and the picture is completely different.

of

S&P 500

It hit its 31st record high for 2024 on Tuesday and is up 15% since the start of the year.

Nasdaq Composite Index

With a record 20 deals in 2024, up 19%, it looks like investors have a lot to be happy about.

But Jordan Klein, a managing director at Mizuho, said: “No one on the tech buyer side seems satisfied.”

Like Tolstoy's unfortunate family, they have clear reasons for feeling that way: With software lagging, these investors despair that nothing is coming to lure AI money their way, Klein writes. But even the semiconductor and hardware stocks that have attracted the bulk of the capital are having their own troubles, as growing concentration leads to fewer winners and the looming fear that it will eventually “end badly.”

Moreover, internet-focused stocks have also struggled recently, small-cap stocks have been on a rollercoaster ride, and fintech “still feels like a potential minefield for a lot of people,” Klein said.

Advertisement – Scroll to continue

Given this widespread discontent, investors might be tempted to take their ball and go home, especially if even the winning side worries about how expensive the technology is and how sustainable the gains are.

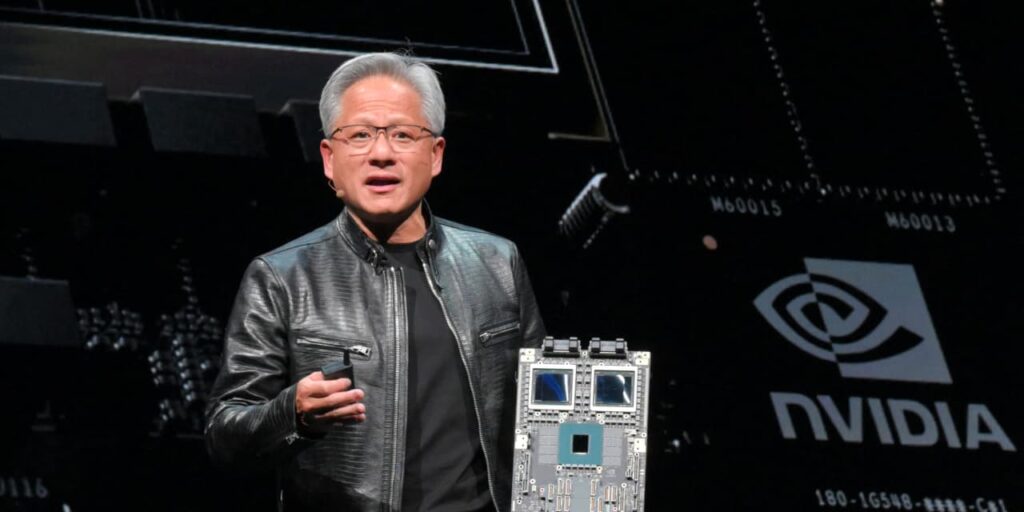

But that's a mistake, says Klein, arguing that anyone betting that AI is at its peak is likely to fail: “The AI train doesn't feel like it's slowing down one bit… I don't have any great answers or solutions to this madness, but I wouldn't recommend fighting it and rushing out of winners like Nvidia.”

,

Broadcom

,

And Micron Technology still is.”

In that respect, he's echoing the same advice as other strategists like Trivariate Research, which argued last week that the AI rally is likely to remain “innocent until proven guilty” — in other words, it's unlikely to slow down just yet, and the big winners are likely to get even bigger.

Advertisement – Scroll to continue

That's no surprise, since sticking with the tech giants is unlikely to mislead investors. “AI adoption is not linear,” meaning different aspects of the technology are “susceptible to mean reversion,” wrote Dennis Debusschere of 22V Research. “For now, First Order Trade (NVDA) is performing best.”

Solita Marcelli, UBS's chief investment officer for the Americas, made much the same point on Thursday.

“AI investments have been led by financially strong companies with quality revenue, high profitability and healthy cash flows,” she wrote. “We believe this financial stability mitigates the risk of a speculative bubble, which means mega-caps are at the core of the AI story.”

Advertisement – Scroll to continue

Given that we expect vertically integrated oligopolies to control the entire supply chain, it is hard to argue against the continued profits of these giants.

Ultimately, investors have good reason to be nervous, but for now there's no obvious reason to assume the music is about to stop.

Email Teresa Rivas at teresa.rivas@barrons.com.