(Bloomberg) — Chip makers led gains in Asian shares and the yen strengthened against the dollar as Wall Street rallied ahead of earnings reports from major technology companies.

Most read articles on Bloomberg

The MSCI Asia Pacific Index recovered from three straight days of losses, with Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. leading the way. U.S. stock futures fell but Euro Stoxx 50 futures rose ahead of earnings reports from Tesla and Alphabet later on Tuesday.

Markets are taking a breather after stock price rally and sector rotation triggered heavy selling in tech stocks over the past few sessions. US election trends continue to dominate headlines, but Kamala Harris has secured enough delegates to secure the Democratic presidential nomination and the outlook is clear in that regard.

“Financial conditions seem to have eased a bit and volatility appears to have eased from last week's highs, so overall it's positive, but not enough to be sustainable,” said Matthew Haupt, portfolio manager at Wilson Asset Management. As for the U.S. data, “it's up to the labor market to see if the slowdown turns into a downturn,” he added.

The yen strengthened against the dollar on the prospect that traders will reduce their positions during the summer vacation season. Some at the Bank of Japan are open to raising interest rates at its July meeting, while others see weakness in consumer spending as making that decision difficult, according to people familiar with the matter.

The Bloomberg Dollar Index fell for a second straight day. Treasury yields fell ahead of this week's economic data and an inflation gauge closely watched by the Federal Reserve. For much of July, short-term Treasury yields rallied on expectations of a September rate cut, narrowing the gap with longer-term Treasuries.

In the corporate world, shares in Kako Corp. plummeted after South Korean authorities arrested founder Brian Kim on suspicion of market manipulation. Toyota Motor Corp. is set to announce it will buy back shares from major Japanese banks and insurance companies as part of a 1 trillion yen share buyback plan.

Elsewhere in Asia, Indian Finance Minister Nirmala Sitharaman presented the budget on Tuesday, outlining the economic priorities of Prime Minister Narendra Modi's new coalition government.

Profits await

Companies scheduled to report earnings in the region this week include SK Hynix, Contemporary Amperex Technology and Keyence.

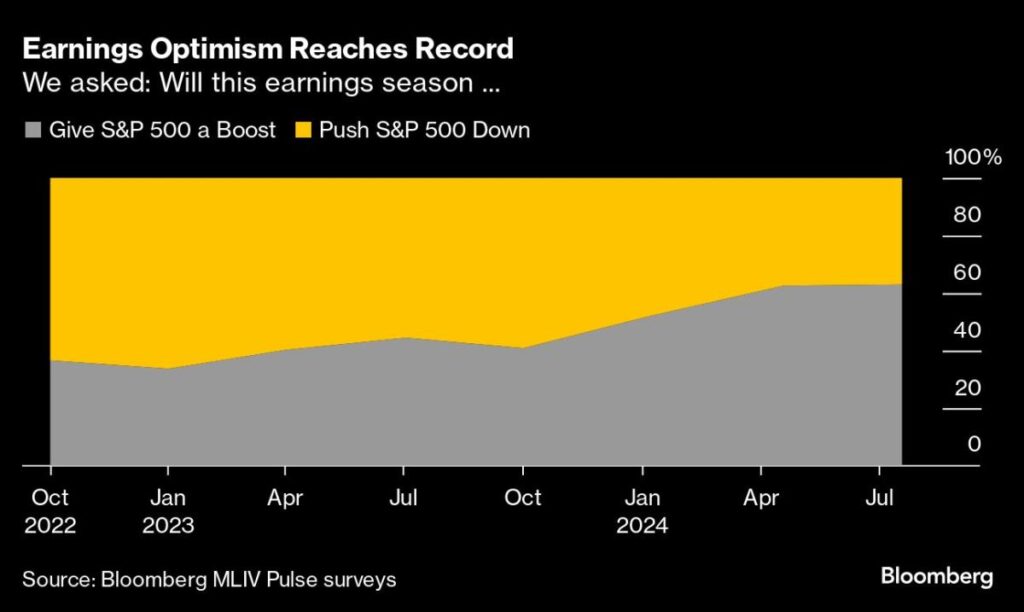

Nearly two-thirds of respondents to Bloomberg's Market Live Pulse survey expect earnings to reinvigorate U.S. benchmark stock prices. The index of the “Magnificent Seven” rose more than 2% on Monday, led by gains in Tesla and Nvidia.

Big technology companies, which have driven U.S. stocks higher for much of this year, hit a wall last week as investors, spurred by hopes of Fed interest rate cuts and threats of further trade restrictions on chipmakers, switched money from high-flying large-cap stocks to riskier, laggard parts of the market.

“Historically, election years have been good for equity investors,” said Kieran Calder, head of Asia equity research at Union Bancaire Privé in Singapore. “The fundamental economic and earnings picture is favorable for the market, and investors believe they will be rewarded for not focusing on the US election drama.”

In commodity markets, crude oil was steady near six-week lows as traders waited for new clues on market balances, including the outlook for U.S. inventories.

Major events this week:

-

Eurozone consumer confidence on Tuesday

-

U.S. existing home sales Tuesday

-

Alphabet, Tesla, LVMH earnings Tuesday

-

Canada interest rate decision Wednesday

-

U.S. New Home Sales, S&P Global PMI, Wednesday

-

IBM, Deutsche Bank Earnings Wednesday

-

German IFO Business Environment, Thursday

-

US GDP, initial jobless claims, durable goods, Thursday

-

U.S. Personal Income, PCE, University of Michigan Consumer Confidence, Friday

Some of the key market developments:

stock

-

S&P 500 futures were down 0.2% as of 6:31 a.m. London time.

-

Japan's TOPIX rises 0.3%

-

Australia's S&P/ASX 200 rose 0.5%

-

Hong Kong's Hang Seng Index fell 0.3%

-

The Shanghai Composite Index fell 0.6%

-

Euro Stoxx 50 futures up 0.1%

-

Nasdaq 100 futures fell 0.3%

-

Australia's S&P/ASX 200 rose 0.5%

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro was little changed at $1.0889

-

The Japanese yen rose 0.4% to 156.42 yen to the dollar.

-

The offshore yuan was little changed at 7.2890 to the dollar.

-

The Australian dollar fell 0.2% to $0.6631.

-

The British pound was little changed at 1.2928 dollars

Cryptocurrency

-

Bitcoin fell 2.4% to $66,525.6.

-

Ether fell 1.6% to $3,435.4.

Bonds

-

The yield on the 10-year Treasury note fell 1 basis point to 4.24%.

-

Japan's 10-year government bond yield remained unchanged at 1.060%

-

Australia's 10-year government bond yield rose 3 basis points to 4.34%.

merchandise

-

West Texas Intermediate crude oil was little changed

-

Spot gold fell 0.1% to $2,393.73 an ounce.

This story was produced with assistance from Bloomberg Automation.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP