We keep hearing about the “green” economy, the transition from dirty energy sources to cleaner and renewable energy sources that have less negative impact on the environment in the long run. The headlines are usually about wind and solar power, but that's not the only thing the world is talking about. By taking a broader view of the clean technology sector, investors can find many opportunities in this space.

That broader vision should also include energy storage, which is key to success in shifting electricity demand away from fossil fuels. Meanwhile, batteries will become an increasingly important need, so we need to focus on lithium.

Two areas of clean technology stocks have already caught the attention of investment research firm Raymond James. Pavel Molchanov, an analyst at the firm, sees them as a sound choice within clean technology, but reminds investors that research remains the key to successful stock investing. “As we always emphasize, clean technology is a stock-picking market,” Molchanov said. “Within each industry, even narrow ones, we still need to focus on each company's positioning (product mix, margins, industry partners, geographic footprint, etc.).”

That's exactly what Molchanov has done, and you can track his two most recent picks using data from the TipRanks platform. These are stocks rated Buys with good upside potential, and Raymond James analysts believe they can diversify to take advantage of tomorrow's tech economy by picking up these clean tech stocks. The time has come to build a type portfolio. Let's check the details.

alkadium lithium (ALTM)

Lithium stocks are probably the most basic way to invest in the battery sector. These companies are engaged in the mining, production, and refining of lithium and lithium-based compounds and metals, which are essential materials for lithium-ion battery technology. Although there are other battery technologies available, lithium-ion batteries are the most commonly used type in most applications, particularly in the electronics and automotive industries.

Arcadium is one of the world's largest lithium producers. With a market capitalization of $4.7 billion and active global operations, Arcadium boasts resource development, production, conversion, and mine-to-metals projects all using lithium, all of which are The aim is to produce the various forms of lithium needed by modern industry. The company has ongoing projects in North and South America, East Asia and the United Kingdom. Arcadium's Bessemer City, North Carolina, facility specializes in the production of high-purity lithium metal and is the only such production facility in the Western Hemisphere.

The company's name and ticker were first registered on the New York Stock Exchange, even though the actual business was not. Arcadium's current form was created through a merger of equals transaction completed in January of this year. Two leading lithium companies, Allkem and Livent, have combined their operations to create “the world's leading integrated lithium chemistry manufacturer.”

Arcadium has a series of major lithium production and manufacturing sites at key points in the global lithium supply chain. The company boasts approximately 2,600 employees and its constituent elements had total sales of $1.9 billion in 2022, the last full year they operated separately before the merger process began. . In 2023, when the two companies completed their combined operations, the combined sales would be $2 billion. Arcadium expects to realize synergies and cost savings of between $60 million and $80 million during 2024 from the merger.

All of this caught Molchanov's attention, but what impressed the analyst most was Arcadium's future expansion potential. “While there is no getting around the fact that the daily trading behavior of all lithium stocks is tied to the underlying commodity, here are three reasons to own Arcadium beyond just a commodity call,” he said. ing. First, with the combined company's initial guidance released in his February, 2024 is on track to be a year of cash flow neutrality, meaning operating cash flow covers nearly all capital expenditures. Healthy growth as the year progresses… Third, there should be increasing evidence of post-merger synergies over the coming quarters. Cost synergies are targeted at $125 million annually by 2027. ”

Raymond James analysts recently upgraded their stance on the lithium stock from “outperform” to “strong buy,” set a $9 price target, and are confident of a 115% one-year upside. It shows. (Click here to see Molchanov's track record)

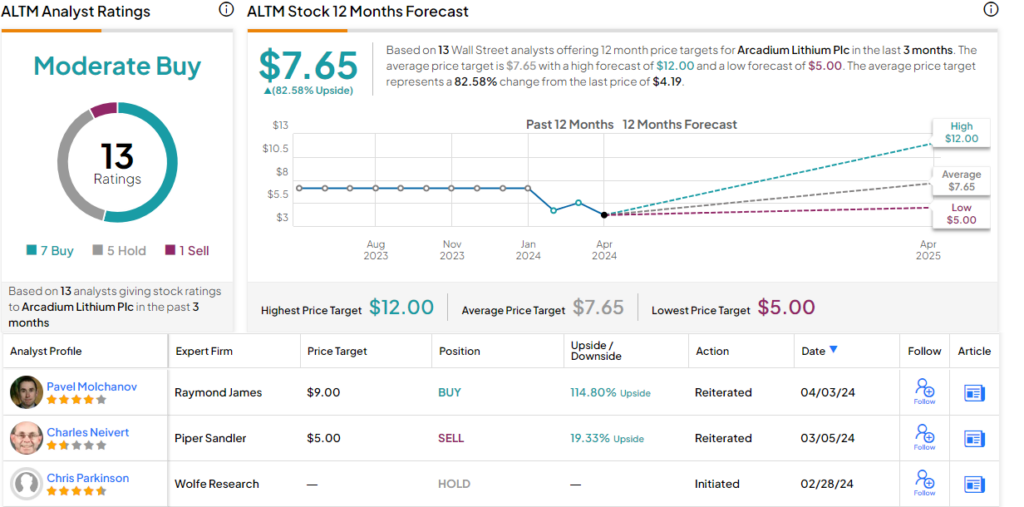

Six other Molchanov colleagues join the bullish camp, with five recommending holding and one pleading to sell, all with a consensus rating of Moderate Buy. Many profits are predicted. The stock is trading at $4.19, and the average price target of $7.65 suggests an 82.5% upside potential over the next year. (look ALTM stock price prediction)

Fluence Energy (FLNC)

The second stock to watch is Fluence Energy, an energy storage specialist. Fluence has created an energy storage-optimized product line that is scalable and economical, can operate on multiple levels, and features a modular structure that can be quickly customized or expanded. Customers can choose from a wide range of installation methods, from large grid-scale systems to small modular units. Fluence also has an energy storage system specifically designed to work in conjunction with photovoltaic panels, which is required to support solar power generation.

Fluence installations are delivered as turnkey projects, based on Gridstack storage units, for quick delivery and setup at customer locations. The company's systems are designed to be online as soon as they are installed so customers can see the benefits right away. Fluence has several lines of energy storage systems for customers to choose from, all of which can be scaled to meet the customer's needs.

Perhaps most importantly, from a customer perspective, Fluence offers four levels of support services, which can also be scaled to suit customer needs. These levels range from “Guided Services” where Fluence teaches a customer's maintenance team how to keep their energy storage system in good shape, to where Fluence handles all aspects of energy storage maintenance and seamlessly completes a project from start to finish. This covers a wide range of areas, including asset management. customer perspective.

The company recently reported its financial results for the first quarter of 2024 (December quarter), showing some significant gains. Quarterly revenue increased 17% year over year to $364 million, and contract balances increased from $2.9 billion as of September 30, 2023 to $3.7 billion as of December 31, 2023. The company's net loss narrowed year over year. This increased from $37.2 million in the first quarter of 2023 to $25.6 million in this report.

Fluence's success in growing its business and reducing losses is appealing to analyst Molchanov, who says of the company: It is not surprising to point out that grid electricity storage reflects the climate change megatrends of both mitigation and adaptation. The former is because intermittent renewable energy (wind and solar) is gaining share in the global electricity mix, and storage is essential for power companies to manage the balance between supply and demand on the grid. reflects the fact that The latter reflects the fact that power grids are experiencing more frequent and severe disruptions due to the worsening climate crisis, and businesses, especially mission-critical ones such as data centers, need to protect themselves from power outages. . With this in mind, storage installations in the US will more than double in 2023, and we're seeing robust growth around the world as well, and this will continue. ”

Getting to the nitty-gritty, the analyst added: “Bottom line: Valuation is down to 14x FY26 adjusted EBITDA and we are ready to go for it.”

This is another stock that Raymond James analysts upgraded. He now changes his rating from Market Perform to Outperform (i.e. Buy). This is complemented by a $22 price target, implying a potential upside of 32.5% for him over the year.

Molchanov is not the only bull here. The company's 13 recent analyst reviews include 12 Buys to a single Hold with a consensus rating of “Strong Buy”, and an average price target of $27.52, while the stock is currently trading at This suggests an increase of almost 66% from the price of $16.61. (look FLNC stock price prediction)

Visit TipRanks to find good ideas for trading stocks at attractive valuations. Best Stocks to Buy is a tool that unites all of TipRanks' stock insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.