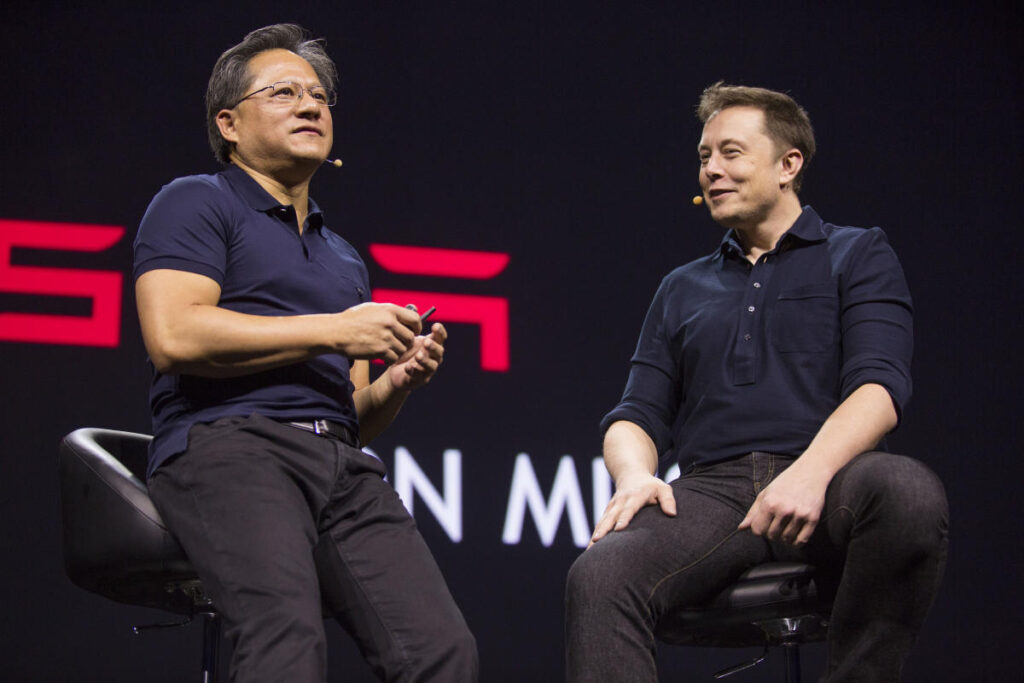

Nvidia (NVDA) CEO Jensen Huang believes Tesla's (TSLA) fully self-driving (FSD) system is the most advanced system available today. Also, coincidentally his Tesla FSD is running on his Nvidia chip.

“Tesla is way ahead with self-driving cars,” Huang told Yahoo Finance in an exclusive interview.

“One of the things that's really revolutionary about Tesla's full self-driving version 12 is that it's an end-to-end generative model,” Huang added.

“Learn by watching videos (surround video), learn how to drive end-to-end, use generative AI to predict and understand routes, and learn how to steer your car. This technology is truly revolutionary. target, [Tesla’s] It's an incredible thing to do.”

Tesla's latest FSD, version 12, is currently in beta mode and was rolled out with a 30-day free trial to new owners earlier this year. FSD currently costs $99 per month, or $8,000 upfront. Tesla reported in April that FSD has accumulated more than 1.3 billion miles driven since its March 2021 debut.

FSD is still considered a Level 2 autonomous system, which means it must be used under supervision and is subject to recalls and government investigations into its functionality.

In the first quarter, NVIDIA reported automotive sales of $329 million. This is a small amount compared to the company's data center business's $22.6 billion in sales, but it was up 17% from the previous quarter and 11% from a year earlier.

Nvidia CFO Colette Kress said on the company's earnings call that the company expects automotive to be “the largest enterprise vertical in our industry.” [the] Data Centres [segment] this year,” which could be a multi-billion dollar business for the company.

Most of Nvidia's data center revenue, which reached $22.6 billion in the first quarter tally, came from consumer internet customers. Cloud providers, or so-called hyperscalers like Amazon (AMZN), Alphabet (GOOG, GOOGL) and Microsoft (MSFT), accounted for a “mid-40% share” of the division's revenue.

Huang also told Yahoo Finance that he expects that one day “all cars will have some degree of self-driving capability.” Its development requires enormous computing power.

“This technology is very similar to that of large-scale language models, but it just requires a huge training facility,” Huang said, referring to Tesla's FSD system. The amount of video data is extremely large. ”

For example, Nvidia says it will help scale the company's FSD training AI cluster to 35,000 Nvidia Hopper H100 GPUs to increase Tesla's massive data processing power.

In addition to Tesla, Nvidia's other auto sector clients include Mercedes, Jaguar Land Rover, Volvo, Hyundai, and Chinese EV startups such as BYD (BYD) and NIO (NIO).

Wall Street is also bullish on Nvidia's auto business.

In a note released Thursday, JPMorgan analysts raised their price target on NVIDIA to $1,150 from $850, modeling the company's data center business to grow at an annual growth rate of 20% to 30%. It modeled NVIDIA as monetizing an “incremental ~$14 billion automotive revenue pipeline.” Next 3-4 years.

Pras Subramanian is a reporter for Yahoo Finance. you can follow him twitter and Instagram.

Click here for the latest stock market news and in-depth analysis, including price-moving events.

Read the latest finance and business news from Yahoo Finance