In this article, Microsoft (NASDAQ:MSFT) and the alphabet (NASDAQ:Google), use TipRanks' comparison tool below to see which one is better. A closer look suggests both have bullish prospects in the long term, but careful consideration could reveal a winner in the short term.

Neither company needs much introduction. Of course, Microsoft is a technology company that provides a variety of software, services, devices, and other technologies to consumers and business users. Alphabet is the parent company of search giant Google, offering apps and content through Google Play, video streaming services through YouTube, and devices such as Chromebooks, smartphones, and smart home products.

Microsoft's stock is up 13.4% year-to-date and 47% since last year, while Alphabet's stock is up 9.2% since the beginning of the year and 40.7% since last year.

Both companies are staples of Big Tech, so their near-identical performance makes perfect sense. Both companies are getting a boost from artificial intelligence (AI), but a closer look at each company's AI advances and revenue mix identifies a clear winner in this combination.

Microsoft (NASDAQ:MSFT)

Microsoft's P/E ratio is 38.6x, trading at a significant premium to Alphabet. The forward P/E ratio is also reasonable at 34.5x, suggesting that future earnings will rise, as expected for a large company like Microsoft. The company's steady progress in AI and its long-term stock price appreciation warrant a long-term bullish view.

First, Microsoft stock has soared 268% in the past five years and 1,147% in the past 10 years, still outpacing Alphabet's stock price (156% and 456%, respectively), which continues to have significant long-term gains. Lately, the company has been performing well in almost every category.

For example, Microsoft's latest earnings report revealed an 18% year-over-year increase in revenue, including a 20% increase in its Intelligent Cloud division and a 30% increase in Azure (cloud computing) revenue. . More Personal Computing segment revenue increased 19% and Productivity and Business Process revenue increased 13%. The only weak spot was search and advertising revenue, which grew only 8%.

This widespread growth shows that essentially every division of Microsoft is growing. This is somewhat unusual among Big Tech companies. This is because many companies are facing many difficulties, and some of them may not be profitable for some time.

Additionally, Microsoft's investment in OpenAI, creator of the ChatGPT chatbot, has paid off in a big way and should continue to pay dividends as the company continues to grow in the coming years. The successful integration of AI into the Azure platform is only the first step, and its success is evident in his 30% increase in Azure revenue.

What is the target price for MSFT stock?

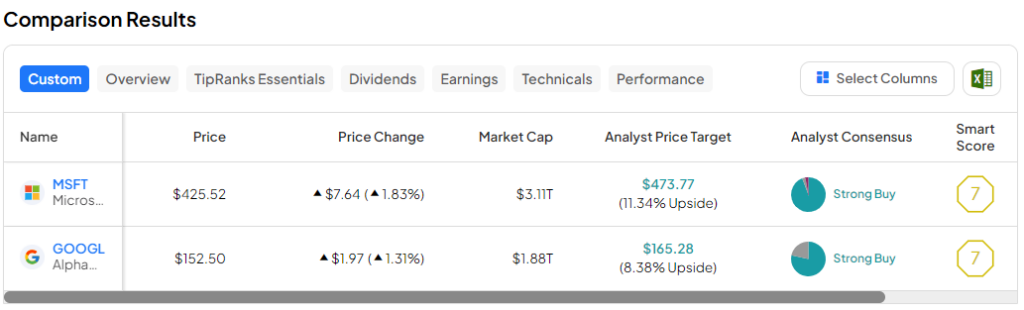

Microsoft has a Strong Buy consensus rating, based on 33 Buy, 1 Hold, and 1 Sell ratings assigned over the past three months. Microsoft's average price target is $473.77, suggesting 11.3% upside potential.

Alphabet (NASDAQ:GOOGL)

Alphabet's P/E ratio is 28.2x, and its forward P/E ratio is 26x, trading at a significant discount to Microsoft. Unfortunately, the company's generative AI bot Gemini was a huge failure from the start, so it will likely take Alphabet even longer to catch up. Furthermore, search is also becoming an area of concern due to AI. But Alphabet isn't going anywhere, so a bullish view seems appropriate over the long term.

First, the latest earnings report raised some questions about the future of search, Alphabet's longtime bread and butter. Alphabet holds more than 90% of the global search market, so if AI continues to make inroads into search, the company could face some setbacks there.

GOOGL's total revenue for the fourth quarter rose 13.5% year-over-year to $86.3 billion, but advertising revenue increased only 11%, falling slightly short of expectations of $65.5 billion. It would be a good idea to continue to monitor Alphabet's search and ad revenue to see if this worrying trend continues.

Meanwhile, Google Cloud's revenue increased 26% year over year, showing strong growth. Of course, the other betting division continued to make losses, but it still recorded a significant increase in revenue from $226 million in the same period last year to $657 million.

Additionally, Alphabet faced a major setback when its Bard chatbot (now named Gemini) failed at launch and shared inaccurate information in a promotional video. Then Alphabet's Gemini chatbot came under fire for displaying historically inaccurate images and refusing to comply with requests to display white people.

So while Alphabet will likely try to bounce back in the AI game, that doesn't mean it's completely lost. More time is needed to perfect the technology. Meanwhile, Alphabet stock may present a buying opportunity.

What is the target price for GOOGL stock?

Alphabet has a Strong Buy consensus rating, based on 29 Buy, 8 Hold, and 0 Sell ratings assigned over the past three months. Alphabet's average price target is $165.28, suggesting 8.4% upside potential.

Conclusion: Long-term bullish view on MSFT and GOOGL

Both Alphabet and Microsoft look like good buy-and-hold positions over the long term, as investors can't go wrong with either stock. However, despite its higher multiple, Microsoft is clearly the short-term winner here.

GOOGL stock offers a buying opportunity based on valuation. But concerns about search revenue, which accounts for the bulk of Alphabet's revenue, could provide a temporary setback for the company. Adding AI issues to the mix only adds to potential short-term concerns about Alphabet, but they appear to be only temporary.

Therefore, Microsoft is the winner in this combination. That's because Microsoft's broad-based revenue growth and Alphabet's focus on search make the potential for near-term growth and stock appreciation look greater.

disclosure