The asset manager for Norway's largest bank has made significant changes to its holdings in major U.S.-traded technology companies.

DNB Asset Management reduced its holdings in Nvidia during the second quarter as the stock outperformed the market and the company acquired Apple and Tesla.

,

He acquired two market laggards and more than doubled his stake in Intel.

.

DNB disclosed the stock transactions in a filing with the Securities and Exchange Commission.

DNB did not respond to a request for comment. The bank has about $88 billion in assets under management.

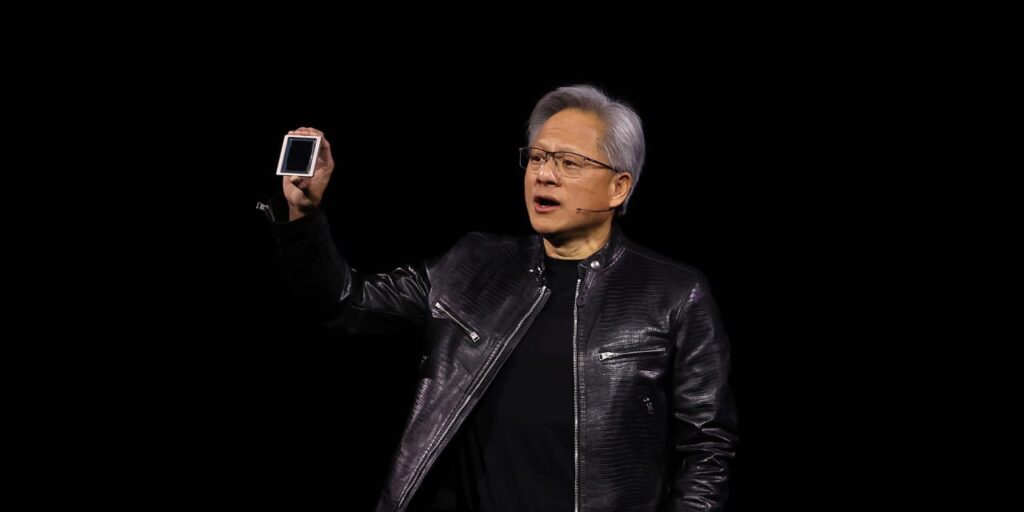

The investment manager sold 908,000 shares of the chipmaker, ending the second quarter with 9.3 million shares. Nvidia shares have risen 150% in the first half of the year, but that compares with a 14% gain in the previous quarter.

S&P 500 Index.

In late May, NVIDIA reported strong first-quarter results and announced a 10-for-1 stock split that went into effect in June. The stock price has continued to rise. So far in the third quarter, NVIDIA shares are up 4.6% compared to a 2.8% increase in the S&P 500 index.

Advertisement – Scroll to continue

Apple's shares have risen 9.4% in the first half of 2024. So far in the third quarter, the stock is up 9.5%.

The iPhone maker reported better-than-expected financial results for the second quarter that ended in March. Apple also increased its quarterly dividend and expanded its share-buying program by $110 billion.

DNB bought 605,940 shares of Apple in the second quarter, increasing its holding to 4.2 million shares.

Advertisement – Scroll to continue

The investment manager bought 149,250 shares of electric car maker Tesla, ending the second quarter with a holding of 748,860 shares of the company.

Tesla's first-quarter numbers, released in late April, fell short of expectations, but investors welcomed the announcement that its long-delayed, smaller, cheaper Model 2 would go on sale sooner than expected.

Tesla's shares fell 20% in the first half of 2024. So far in the third quarter, the stock has risen 25%, nearly erasing those losses.

Advertisement – Scroll to continue

Intel shares have yet to make a significant recovery after falling 38% in the first half of the year, though they're up 11% so far in the third quarter.

In April, Intel gave disappointing earnings guidance for the quarter ending in June, with CEO Pat Gelsinger saying: Barons Gelsinger sees things improving in the second half of 2024. “Everybody recognizes the market is a little soft” in everything but artificial intelligence training, he said. He noted there are upsides to the second half of the year, including the resolution of excess inventory issues.

DNB bought 3.3 million Intel shares, bringing its holdings to 5.7 million at the end of the second quarter.

Inside Scoop is a regular feature from Barron's highlighting stock trades by company officers and directors – so-called insiders – major shareholders, politicians and other prominent people. Because of their insider status, these investors are required to disclose their stock transactions to the Securities and Exchange Commission and other regulatory bodies.

Follow Ed Lin by emailing edward.lin@barrons.com translator.