Market Thoughts 160624: US tech stocks gain momentum while France weighs on eurozone

In short, the stock market is still trending up, but buying opportunities will arise as the market moves three steps forward and one step back.

Once the current correction subsides, look out for potential entry opportunities into European equities (e.g. banks), UK equities, and precious and industrial metals (e.g. copper).

Soon there may be a good opportunity to sell pounds and buy euros at or near 1.20 euros per pound.

Podcast – Opportunities in Today's Unpopular Stock Market (click here for the link to the webpage)

In this podcast, Global Chief Investment Officer,

Philippe Gysels, Chief Investment Advisor at BNP Paribas Fortis

Belgium discusses investment opportunities and unpopular stock market.

Podcast – Copper Investability (click here for webpage link)

In this podcast, Edmund Shin and Xavier Timmermans discuss the recent surge in copper prices and its potential for higher value.

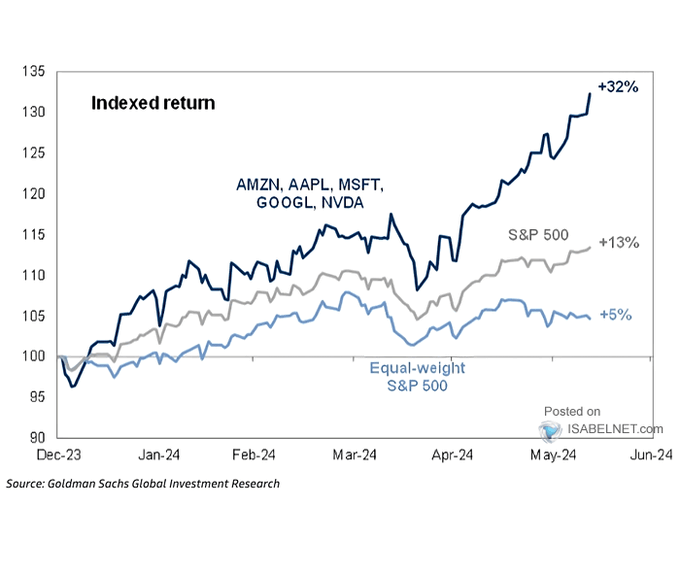

No signs of the AI bubble bursting yet

The U.S. stock market continues to lead global markets, with small leads from Nvidia, Apple, and Google driving the Nasdaq 100 and S&P 500 indexes.

Mega-cap tech leadership continues

Source: tradingview.com

I really don't know what more to say about leadership in this narrow AI-related technology market…

But it remains a concern for me.

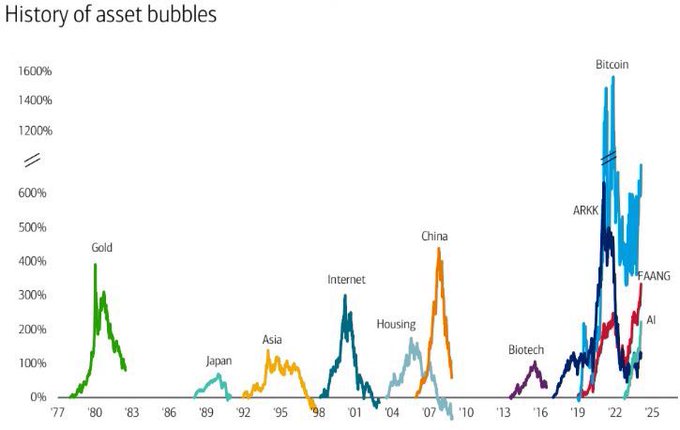

Also remember this chart…whatever spikes can also contract very quickly (at some point)…

Source: Bank of America

Outside of big tech companies, the anti-obesity theme continues to drive strong performances in the healthcare sector in Europe and the US.

Healthcare is booming thanks to Novo Nordisk and Eli Lilly

Source: tradingview.com

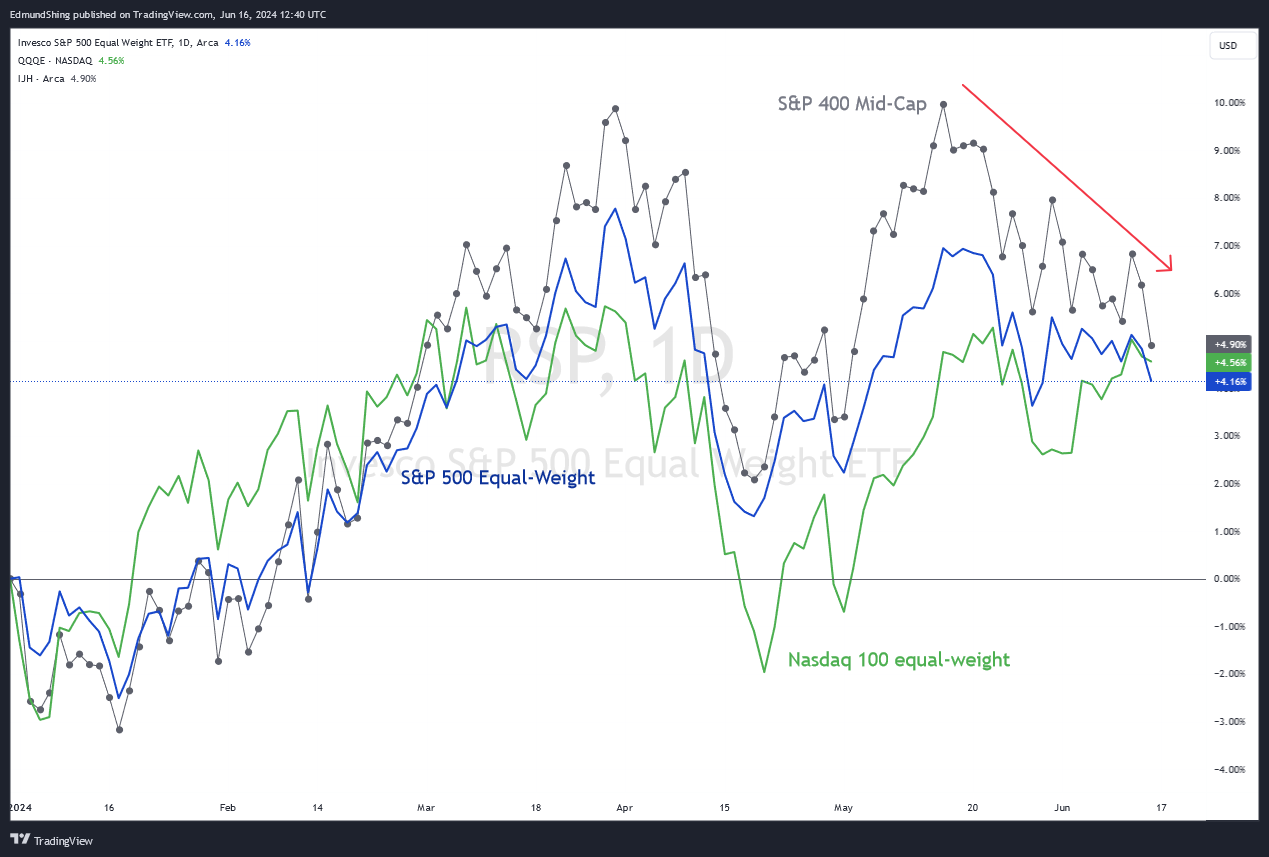

but, US stock averages are falling, and even the Nasdaq 100 average is not keeping up with the big tech leaders.

But average U.S. stocks, even the average Nasdaq 100 index stock, are falling. Don’t follow the technology leaders

Source: tradingview.com

Eurozone stock markets have been hit hardest…

Do you already have an account?

Log in here