We recently Top 10 renewable energy penny stocks to invest in In this article, we'll discuss whether ESS Tech, Inc. (NYSE:GWH) is the top renewable energy penny stock to buy now.

Renewable Energy Investments

The renewable energy sector has experienced growth in recent years, driven by increasing government investments in the energy transition as the world moves away from fossil fuels. However, inflation and high interest rates have put the sector on an uncertain footing in 2023. Analysts believe the renewable energy market will bounce back this year, driven by growth in solar and wind power. Recently, on May 23, Reuters reported that renewable energy giant Orsted secured a $680 million tax equity financing investment from JP Morgan to fund 250 and 300 megawatt solar battery storage projects in Texas and Arizona, respectively. The investment takes advantage of the Inflation Reduction Act tax credit, signaling its potential to accelerate clean energy adoption in the United States. The Arizona facility will receive a one-time investment credit for the battery storage stem. Prior to this deal, JP Morgan had made other investments in Orsted's 1.8 GW onshore portfolio in the United States. Both projects are scheduled to begin operation in 2024.

The renewable energy market is gaining momentum in 2024. Over the past month, major renewable energy exchange-traded funds (ETFs) have shown a surge in returns. As of May 28, the leading clean energy ETF, iShares Global Clean Energy ETF, has surged 11%, while First Trust Nasdaq Clean Edge Green Energy Index Fund has risen 14%. This growth has also extended to solar stocks, with the Invesco Solar ETF rising 14% in the past month. The solar stock boom is typified by First Solar, whose shares have surged more than 50% in the past month, significantly outperforming the overall market and leading the surge. Analysts' top 7 alternative energy stocks.

Clean Energy to Power AI

According to the International Energy Agency's forecast, global electricity consumption from data centers, cryptocurrency, and AI sectors could double by 2026. This provides a great opportunity for the clean energy sector to make profits. Recently, on May 24, Oklo CEO Jake DeWitt appeared in an interview with Yahoo Finance Catalysts to discuss the company's business model and energy outlook. Oklo is an advanced nuclear technology company that develops and designs nuclear fission power plants to provide reliable commercial-scale energy to customers in the United States. The company aims to create clean energy and is also backed by OpenAI founder Sam Altman. DeWitt said Oklo is employing next-generation nuclear technology that could potentially power the Earth for over a billion years. The CEO believes that energy demand is increasing as the artificial intelligence sector relies on clean energy to operate. Oklo's business model revolves around selling the electricity it generates through long-term contracts to major energy consumers for AI, such as data centers. This gives the company recurring revenue to continue developing and deploying clean energy solutions.

Moreover, this revenue stream will enable the company to leverage project financing and benefit from government investment tax credits. DeWitt also spoke about a partnership with data center company Wyoming Hyperscale, which will enable Oklo to integrate clean energy with advanced liquid cooling technology in data centers. The partnership could potentially allow waste heat from nuclear reactors to be used to cool data centers. The two companies signed a 20-year power purchase agreement. Also, check out our free report, 7 Unstoppable AI Stocks to Buy.

An undervalued renewable energy company with high growth potential

Tigo Energy is a solar power and energy storage company that develops module-level power electronics (MLPE). MLPE helps solar modules reach their maximum energy output. The company also offers GO Energy Storage Systems with solar storage management capabilities and an energy intelligence (EI) platform. Founded in 2007, the company serves residential, utility and commercial customers in the United States, Europe, the Middle East, Asia Pacific and Africa. According to analysts, the company's stock is also one of the cheapest clean energy stocks to buy. On May 8, the company announced the launch of its latest Tigo Flex MLPE product line, the Tigo TSX-4. The new MLPE is designed for large commercial and industrial solar power projects. It is compatible with solar modules with up to 800 watts of power. The new TSX-4 series offers increased power output, reduced costs, optimization and advanced monitoring.

Emeren, another leading renewable energy company, operates, develops and constructs solar photovoltaic projects. The company's portfolio consists of a 3 gigawatt project pipeline and independent power producer (IPP) assets. It is also involved in the design and procurement of solar modules and other components. On April 23, the company announced that it had partnered with Nuveen Infrastructure to develop a battery storage project in Italy. The agreement finalized the cooperation for 2.83 GWh of capacity, as well as the development of two additional battery storage projects. Construction of the projects is expected to begin in 2024 and be operational by 2026.

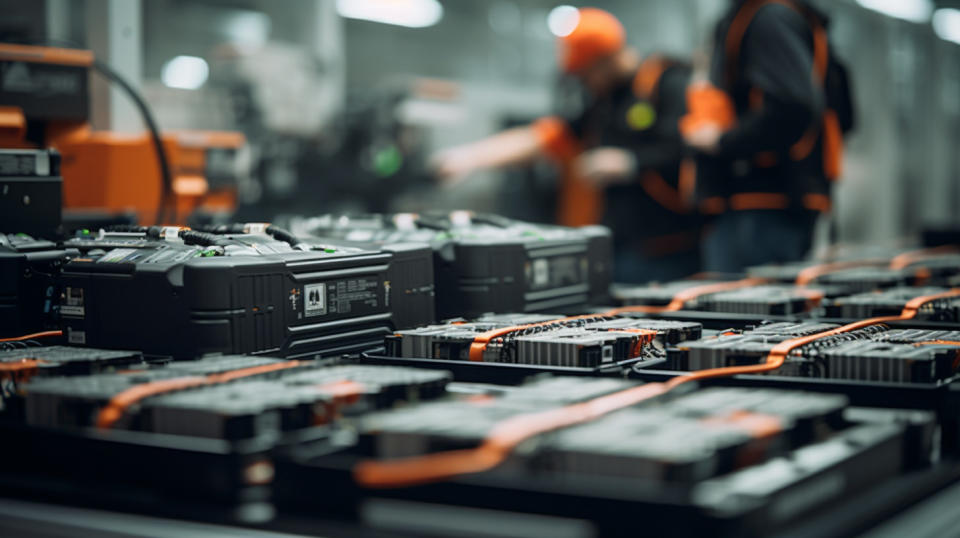

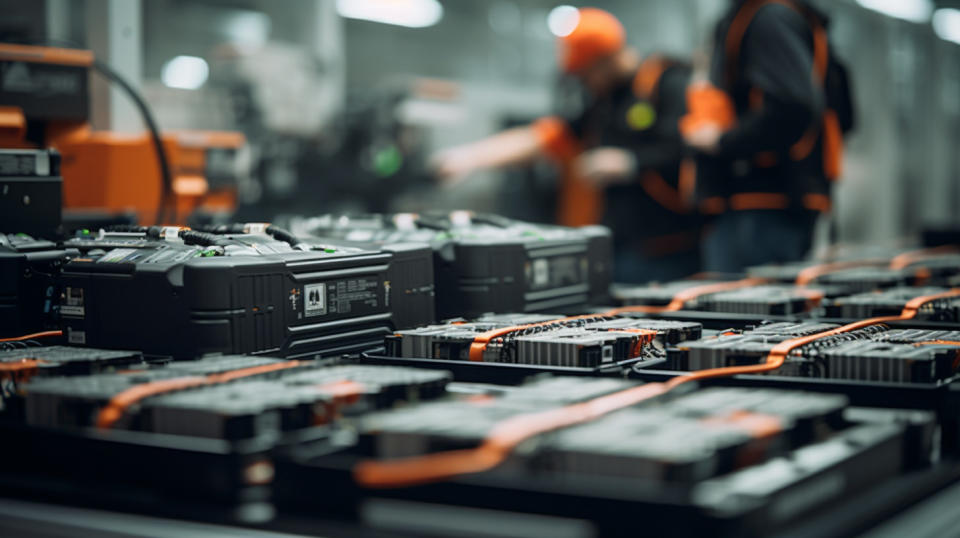

An assembly line for lithium-ion batteries for energy storage solutions, with workers behind them.

methodology

To compile our list of the 10 best renewable energy penny stocks to invest in, we used stock screeners from Yahoo Finance and Finviz to list stocks trading below $5 as of May 28. We also looked at multiple similar rankings by Insider Monkey and various clean energy ETFs to compile our list of 30 best renewable energy penny stocks. We selected the 10 stocks with the most buy or buy equivalent ratings from Wall Street analysts and the highest average upside potential as of May 28. Finally, we obtained hedge fund sentiment for each stock. Hedge fund data was taken from Insider Monkey's database of over 900 elite hedge funds as of Q1 2024. The top 10 best renewable energy penny stocks to invest in are listed in ascending order by number of hedge fund holdings as of Q1.

At Insider Monkey, we stick to stocks that hedge funds are concentrating their investments on. The reason is simple: our research shows that you can outperform the market by mimicking the top stock picks of the best hedge funds. Our quarterly newsletter strategy selects 14 small and large stocks each quarter, and has returned 275% since May 2014, beating the benchmark by 150 percentage points. (Click here for details).

Is ESS Tech, Inc. (NYSE:GWH) the best energy storage penny stock?

ESS Tech (NYSE:GWH)

Stock price as of May 28: $0.79

Number of hedge fund holders: 7

ESS Tech, Inc. (NYSE:GWH) is an energy storage company engaged in the design and manufacture of iron flow batteries for utility-scale and commercial-scale energy storage applications. The company's energy storage products include energy warehouses and energy centers.

ESS Tech, Inc. (NYSE:GWH) released its first quarter 2024 results on May 7, reporting EPS of -0.10, beating expectations by $0.01. Quarterly revenue was $2.74 million, up more than 600% year over year. The company also recently announced a partnership with Sapele Power, a Nigerian power generation company with 1 terawatt of capacity. ESS Tech, Inc. (NYSE:GWH) will provide energy storage services to the company and begin the initial deployment phase with 8 megawatt-hours of storage to improve the efficiency of Sapele's assets. The installation, backed by the U.S. Export-Import Bank, will increase grid resiliency and offset backup generators. Future phases will include 50 megawatts of battery storage to support a green load base. The deal highlights the need for long-duration energy storage and positions ESS Tech, Inc. (NYSE:GWH) as a strong contender in the market. The project will bring the company's rated power module capacity to over 1 gigawatt-hour per year.

According to data from Insider Monkey, seven hedge fund managers held $605,000 worth of ESS Tech, Inc. (NYSE:GWH) shares at the end of the first quarter. On May 8, TD Cowen analyst Thomas Boyes maintained a buy rating on the stock and revised his price target from $2.50 to $2.

ESS Tech Corp. (NYSE:GWH) is ranked #6 on our list of renewable energy penny stock investments. To find out more top-ranked stocks, check out our free report. Top 10 renewable energy penny stocks to invest in.

While we see the potential in these renewable energy stocks, we believe AI stocks have a better chance of delivering higher returns in a shorter time frame. If you're looking for AI stocks that are more promising than NVIDIA but still trade for less than five times earnings, check out our report on the cheapest AI stocks.

Read next: Michael Burry is selling these shares. and Jim Cramer's recommended stocks

Disclosures: None. This article was originally published on Insider Monkey.