key insights

-

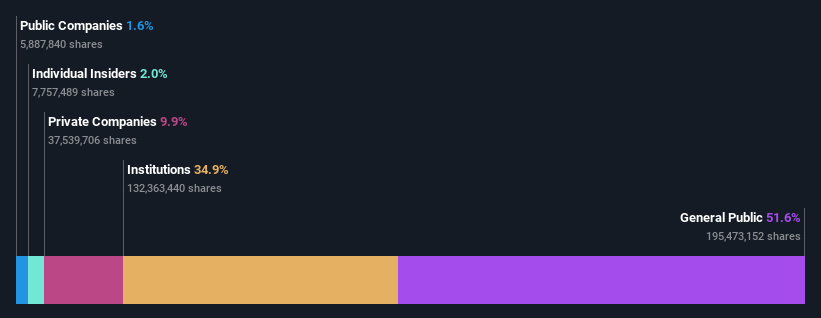

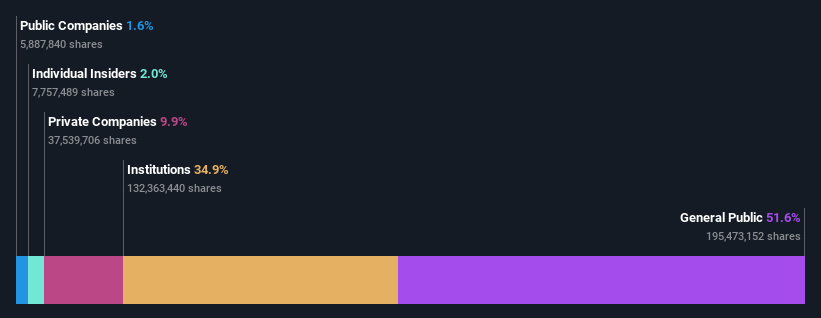

Significant control over MMA Offshore by retail investors means the general public has more power to influence management and governance-related decisions

-

The top 25 shareholders own 48% of the company

-

35% of MMA Offshore is held by institutions

Every investor in MMA Offshore Limited (ASX:MRM) should be aware of the most powerful shareholder groups. The group that owns the most shares in the company (about 52% to be exact) is retail investors. That is, if the stock price rises, the group will gain the most (or if the stock price falls, it will suffer the maximum loss).

Meanwhile, institutional investors account for 35% of the company's shareholders. Typically, as a company grows, institutions' ownership increases. Conversely, insiders often decrease their ownership over time.

The chart below zooms in on the different ownership groups for MMA Offshore.

Check out our latest analysis for MMA Offshore.

What does institutional ownership tell us about MMA Offshore?

Many institutions measure performance based on indicators that approximate local markets. So they usually pay more attention to companies that are included in major indices.

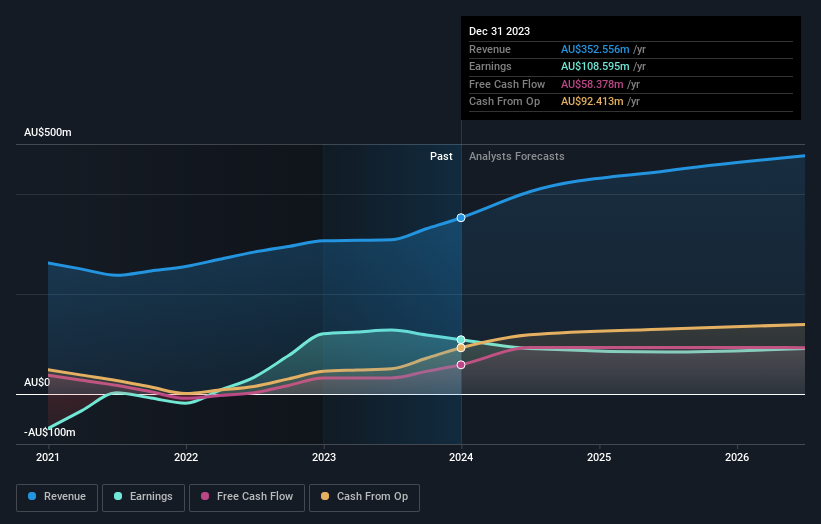

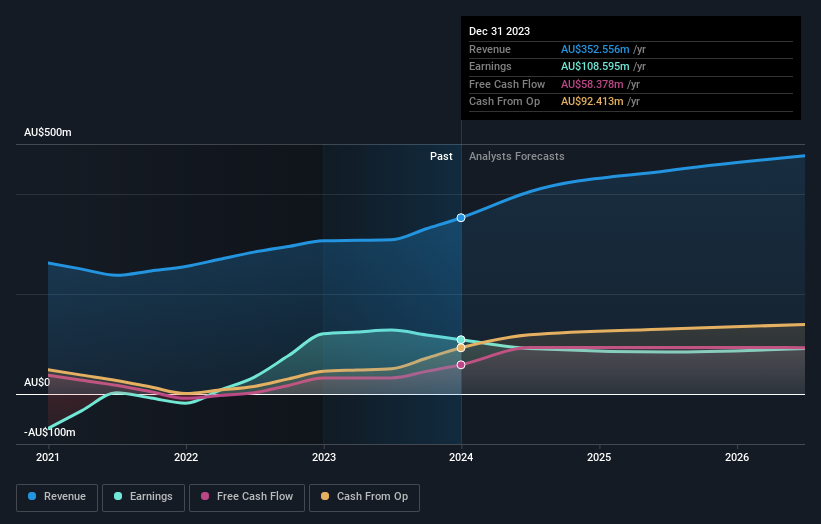

We can see that MMA Offshore does have institutional investors. And they own a significant portion of the company's stock. This implies the analysts working for these institutions have considered the stock and they like it. But just like anyone else, they can be wrong. If multiple financial institutions change their view on a stock at the same time, you could see the stock price drop fast. It is therefore worth checking MMA Offshore's earnings history, below. Of course, what really matters is the future.

MMA Offshore is not owned by hedge funds. According to our data, Halom Investments Pte Ltd is his largest shareholder with 7.7% of shares outstanding. For context, the second largest shareholder holds about 4.8% of the shares outstanding, followed by an ownership of 4.6% by the third largest shareholder. Furthermore, the company's CEO David Ross directly holds 0.6% of the total outstanding shares.

A closer look at our ownership data reveals that the top 25 shareholders collectively own less than half of the register, with a large number of smaller shareholders with no single shareholder controlling the majority. This suggests that it is a group of people.

Researching institutional ownership is a good way to assess and filter a stock's expected performance. The same can be done by studying analyst sentiment. There are plenty of analysts covering the stock, so it might be worth seeing what they are predicting.

Insider Ownership of MMA Offshore

The definition of an insider may vary slightly from country to country, but members of the board of directors are always considered. A company's management runs the business, but the CEO answers to the board, even if he or she is a member of the board.

I generally consider insider ownership to be a good thing. However, in some cases, it may be more difficult for other shareholders to be held accountable for board decisions.

Shareholders would probably be interested to know that insiders own shares in MMA Offshore Limited. It has a market capitalization of just AU$891m, but insiders have AU$18m worth of shares in their own names. It's good to see insider investment, so it might be worth checking if those insiders have been buying.

Open to the public

The general public, including retail investors, owns 52% of MMA Offshore. This level of ownership gives retail investors a degree of power to influence important policy decisions such as board composition, executive compensation, and dividend payout ratios.

Private company ownership

It appears that 9.9% of MMA Offshore shares are held by private companies. It might be worth looking into this further. If insiders or other parties have an interest in these private companies, this must be disclosed in the annual report. Private companies may also have a strategic interest in the company.

Next steps:

It's always worth thinking about the different groups who own shares in a company. However, to better understand MMA Offshore, you need to consider many other factors. For example, we identified 3 warning signs for MMA Offshore (Note that 1 will be a little unpleasant).

But in the end it's the futureIt, not the past, determines how well the owner of this business will do. So we might consider this free report showing whether analysts are predicting a bright future.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.