Leo Patrizi

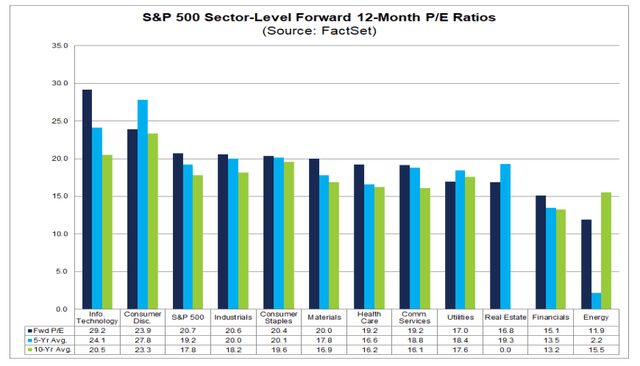

The AI arms race has never been hotter. As of the close of trading last Wednesday, there were three companies with market capitalizations over $3 trillion. All of them are in the information technology sector. IT currently accounts for 31.2% of the S&P 500, and the sector's forward price-to-earnings ratio is It's 29.2 times.

Cash continues to flow into the sector, with tech ETFs now accounting for nearly 30% of total fund assets, according to Goldman Sachs. But is there room for this attractive group to continue to grow? In the short term, perhaps, but long-term valuation is a concern.

I am a member of the Fidelity MSCI Information Technology Index ETF (NYSEARCA:FTECUnlike the popular Technology Select Sector SPDR® Fund ETF (XLK), FTEC is allowed to hold many stocks, not just the largest pair. Of technology companies.

S&P 500 Sector Ratings

FactSet

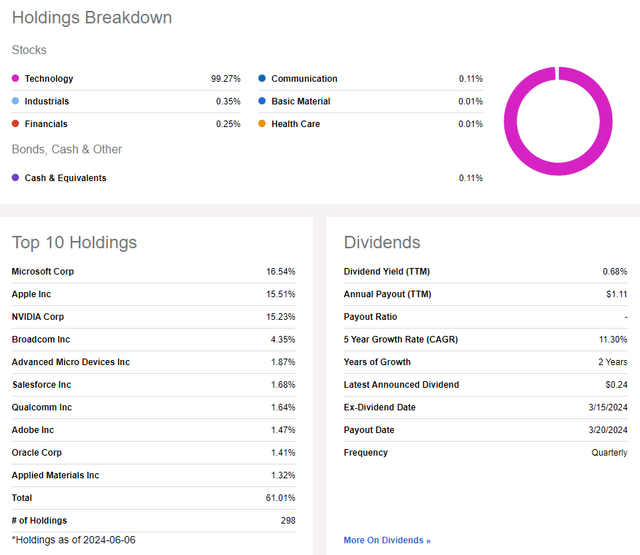

by IssuerFTEC seeks to provide investment returns, before fees and expenses, generally match the performance of the MSCI USA IMI Information Technology 25/50 Index, which is composed of companies operating in the information technology sector. FTEC invests in growth and value stocks across a diverse range of market capitalization companies.

FTEC is a large ETF with over $10 billion in assets under management as of June 7, 2024. Annual expense ratio: 0.08% It is an ideal holding for long-term investors looking for efficient access to the U.S. IT industry. Furthermore, the fund offers low yields. Dividend yield: 0.68% This is great from a tax management perspective, but income investors will likely look elsewhere for yield.

Stock price momentum FTEC has performed extremely well over the past few quarters and has been given a top ETF rating of A+ by Seeking Alpha. Sometimes dangerousHowever, the annual standard deviation is somewhat high, which indicates the concentrated allocation. Liquidity Indicators According to Fidelity, the fund's average daily trading volume is more than 200,000 shares, and the average 30-day bid-ask spread is just 3 basis points.

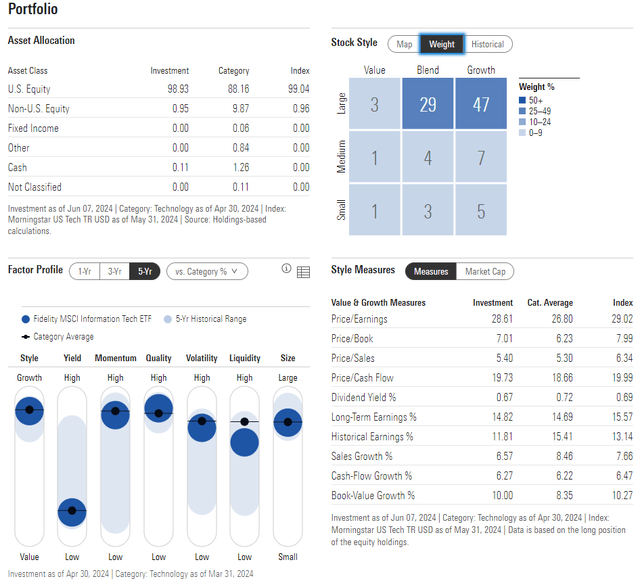

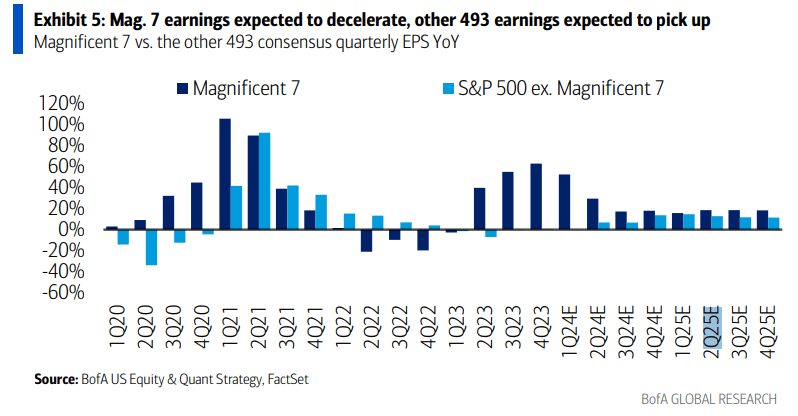

Zooming out into the portfolio, Morningstar's four-star, Silver-rated ETFs plot at the very top of the style box. Given the generous exposure to large-cap stocks, the bulk of the allocation is actually outside the box. About one-fifth of FTEC is considered the size of a SMID can, with only 5% invested in value stocks. With a P/E approaching 30 and long-term EPS growth of 15%, the PEG ratio is close to 2, making it hardly a bargain. Additionally, small-cap EPS growth is expected to outpace large-cap stocks in the second half of 2024, which could shift bullish attention away from large-cap tech stocks later this year.

FTEC: Portfolios and Factor Profiles

Lucifer

Mag 7 EPS growth is on the decline

BofA Global Research

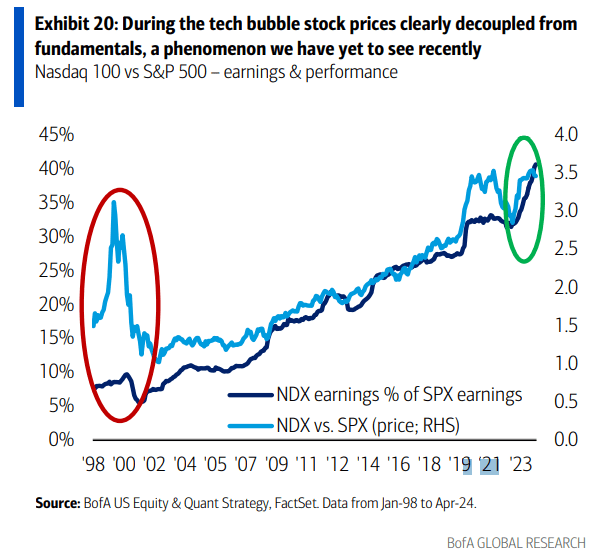

The basis of the technology remains sound, unlike what was seen around 2000.

BofA Global Research

The real difference between FTEC and XKK is the percentage of each fund's top 10 holdings. FTEC has a massive 46% investment in three stocks: Microsoft (MSFT), Apple (AAPL), and NVIDIA (NVDA). In contrast, XLK has less than 6% invested in NVDA due to fund size constraints.

So, if you're looking for a tech ETF with significant exposure to NVDA, FTEC makes more sense to choose.No matter how you slice it, it's important to keep a close eye on three big-name tech names: Broadcom (AVGO) is the fourth-largest position, and the company reports its quarterly earnings later this week.

FTEC: Focus on three major companies: MSFT, AAPL, NVDA

Find Alpha

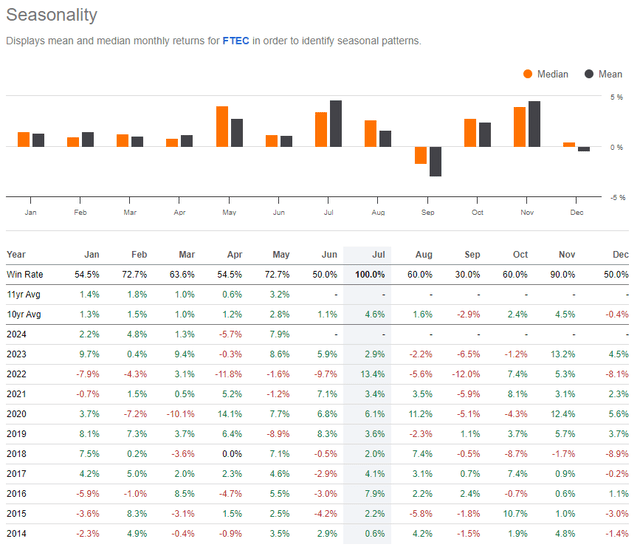

I said earlier that I believe FTEC has room to grow in the near term. One of the reasons I say this is seasonal bullishness. Over the past decade, the June to August period has been historically bullish. Specifically, FTEC returned an average of 4.6% in July, with a 100% positivity rate.

FTEC: Summer trends are very bullish

Find Alpha

Technical insight

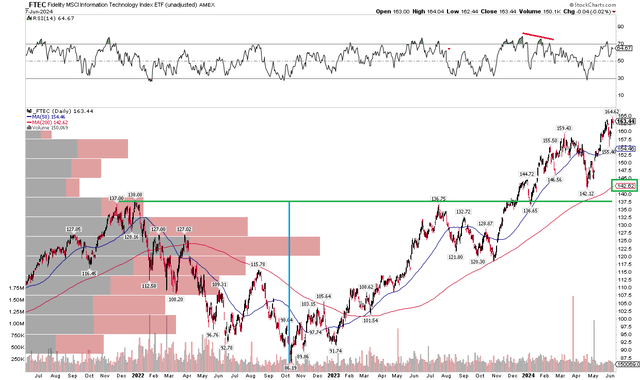

FTEC continues to show bullish technical trends, even though valuation is a risk and concentration is a concern. The stock is in a notable uptrend, as can be seen in the chart below, with the stock price above both its 200-day and 50-day moving averages, and the long-term 200-day moving average rising. Additionally, FTEC bulls defended key support in the $137-$138 range during the March-April selloff. The fund never got as close to the 200-day moving average as it did in October of last year. In fact, FTEC has been above the 200-day moving average since the bullish golden cross in the first quarter of last year.

Longer term, we see a price target of $190 based on the cup and handle pattern high of $52 from late 2021 through Q4 last year. Adding $52 to the breakout price of $138 gives us $190. With no natural sellers above last Friday's close, the outlook is bright.

Overall, FTEC is in a strong bull market, ideal for swing investors looking to ride the momentum, with support currently located near the $155 mark.

FTEC: Bullish uptrend, 200-day moving average rising, technical target at $190

Stock Chart

Conclusion

While technically solid, FTEC is overvalued heading into the second half of the year. These mixed characteristics have resulted in me issuing a Hold rating, despite a seasonal bullish trend over the coming months.