In a recent segment on CNBC's “Mad Money,” Jim Cramer gave its approval to Data Dog Co., Ltd. (NASDAQ:DDOG), described the technology company as a “dynamite company.”

what happened: On Monday, CNBC reported that Cramer had a positive attitude towards Datadog despite its high valuation. In response to audience questions, he pointed to the company's management strength and solid outlook.

“I think this is a dynamite company and it's a buy. It's expensive, but they really know what they're doing,” he noted.

Datadog is a US-based company that provides observability services at scale for cloud-based applications. With the increasing adoption of cloud technology, Datadog has experienced rapid growth and expanded its product range to encompass a variety of service providers, including: Amazon Web Services (AWS), microsoft azure, Google cloud platform, red hat open shift, vmwareand open stack.

SEE ALSO: 10 IT Stocks Whale Activity in Today's Session

why is it important:Earlier this month, 18 financial analysts offered opinions on Datadog ranging from bullish to bearish. Analysts set an average 12-month price target for the company at $147.44, a significant increase from the previous target of $126.33.

Additionally, Datadog's float percentage short increased by 18.08%. The company reported 11.77 million shares sold short, representing 4.18% of the total shares available for trading. Data suggests that it takes traders approximately 1.81 days to cover their short positions.

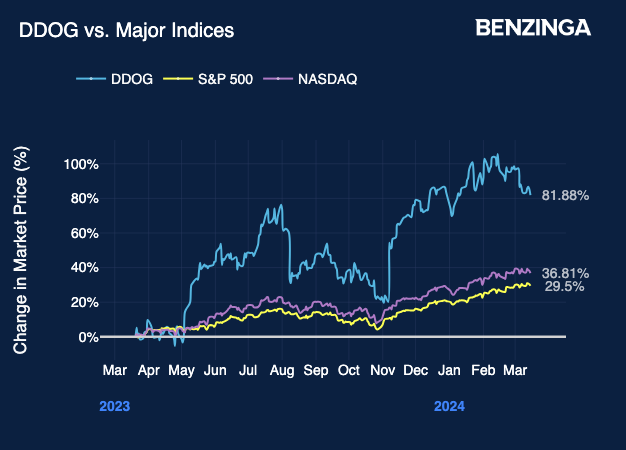

Price action: The company's recent performance has shown resilience, with Monday's closing price at $120.87. This is a slight increase from the previous closing price of $120.42, and the stock has fluctuated between a 52-week high of $138.61 and a low of $62.597.

Read Next: Datadog's FY24 Earnings Consensus Doesn't Match Trends in Management's Historical Guidance

Image by rafapress via Shutterstock

Designer Benzinga Neuroedited by

Pooja Rajkumari

The GPT-4-based Benzinga Neuro content generation system leverages the extensive Benzinga ecosystem, including native data, APIs, and more, to create comprehensive, timely stories. learn more.