Warner Bros. Discovery (WBD) remains in the news over its contentious negotiations with the NBA. The expectation around the NBA is that the league will sign new rights deals with Disney, Amazon and Comast, leaving WBD’s TNT out of the mix.

However, the NBA is not the only package WBD has been trying to retain. The network’s rights deal with All Elite Wrestling (AEW) runs until early next year and its exclusive negotiation window expires in July.

AEW is the second-largest wrestling promotion in the world, behind WWE. The company provides WBD with five hours of live programming per week. “Dynamite,” AEW’s flagship program, is often one of the top three-rated shows on cable on Wednesdays, often topping all non-NBA programming.

If WBD loses the NBA, AEW would be its most-watched show on cable, ahead of the NHL and MLB.

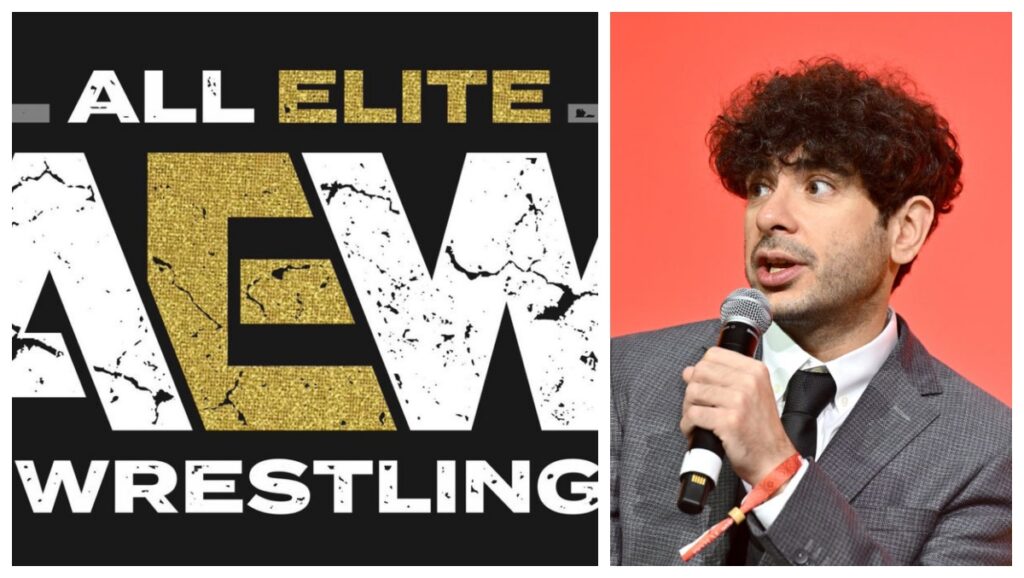

A report from Puck News on Tuesday claimed AEW owner Tony Khan (son of Jaguars owner Shad Khan) is “disappointed” with the current offer from WBD. What does “disappointed” mean? Not much.

It’s typical for negotiations to run until the final inning. Khan has little incentive to agree to a new deal until at least July.

Right now, AEW is one of the biggest bargains in television, costing WBD only around $50 million a year. AEW is worth substantially more than that. But how much more?

Longtime wrestling journalist Dave Meltzer reported on Friday that the current offer from WBD to AEW is worth more than double its current rate:

“[Per-year figures being discussed between AEW and WBD] It's estimated that the company could theoretically make $110 million a year in profit, or maybe a little more.

“There is talk of a figure being proposed that is 50% or more (up to nearly double) the current figure already under consideration. The latter figure in particular would open the door to tens of millions of dollars more per year for talent acquisition and other budget expansion.”

By comparison, WWE sold “Raw” and “SmackDown” to Netflix and Comcast last year for $500 million and $287 million per year, respectively. Granted, those are weekly shows. The AEW deal would include three different weekly shows (“Dynamite,” “Collision” and “Rampage”) and possibly a monthly pay-per-view.

In theory, Khan should reject any offer from WBD and begin bidding for potential partners later this summer. The problem is that the number of potential bidders is limited.

WWE recently signed new rights deals with Netflix, Comcast and The CW, three companies that are not in contention for AEW.

AEW doesn't have the mainstream name recognition that WWE has, so it's probably less appealing to Amazon or Disney, both of which expressed interest in WWE rights last year.

(Still, it would be wise for Amazon Prime to get into the AEW business in line with its recent investment in PBC Boxing.)

Fox could be an option, but having chosen not to continue business with WWE after four years, FS1 will likely be all Fox can offer AEW.

So is Paramount.

Sources told OutKick that Paramount has been interested in AEW since its inception in 2019, presumably to air the show on Showtime. But unless Paramount airs AEW on CBS (which it won't), Paramount's cable channel (where “Yellowstone” airs) and Paramount+ will be significantly inferior to what WBD offers.

Where else can you air a show from a wrestling company that costs nine figures a year?

You see the problem.

Ultimately, I expect AEW to re-sign with WBD.

AEW is a valuable asset to WBD's cable networks, TBS and TNT, and provides broad streaming potential for WBD's Max service. With the NBA's looming demise and CNN's decline, AEW is Warner Bros. Discovery's last real shot at cable reliability.

And, through no fault of their own, it would be hard for AEW to find a better partner in terms of reach than Warner Bros. Discovery.