Battery-powered Scooptram. Image courtesy of Epiroc.

Increasing demand for nickel, lithium and phosphate, combined with the natural benefits of electrification, is driving the adoption of electric mining equipment. At the same time, a chronic shortage of operators is driving demand for autonomous machines.

The above factors are combining to rapidly accelerate the rate at which machinery already in operation is becoming obsolete. While some companies are considering the cost-effectiveness of converting their existing fleets to electric, or even hydrogen, vehicles, the general consensus seems to be that more companies will be buying new equipment more frequently over the next few years.

For example, Allied Market Research predicts that the global mining equipment market will grow from $141 billion in 2023 to a total of more than $200 billion in 2040, based on a compound annual growth rate (CAGR) of 4.1%, which seems hopelessly slow.

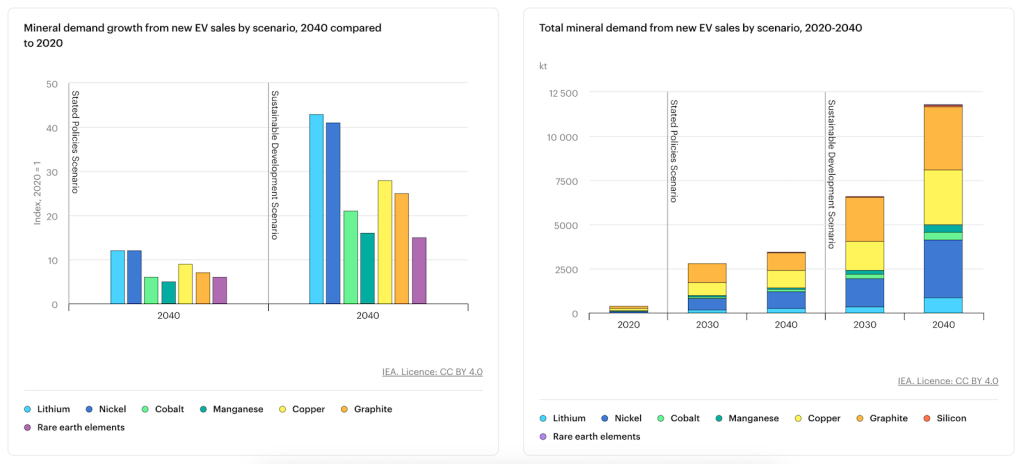

The International Energy Agency (IEA, a Paris-based organization of 31 countries founded in 1974 to provide policy recommendations, analysis and data on the global energy sector) predicts that demand for minerals from EVs will increase 30-fold between 2020 and 2040, while demand for lithium and nickel will increase 40-fold as diesel demand falls faster than most expected, hitting a 26-year low last quarter.

Mineral demand forecast

The IEA projections take into account several battery development scenarios and include familiar terminology like utility-scale battery energy storage, meaning they are rigorously thought out and well-executed and there doesn't seem to be anything obviously crazy going on with scaling etc. (#pythonistas).

A delayed transition to nickel-rich chemistry (and a delayed transition away from cobalt-rich chemistry) would increase cobalt and manganese demand by nearly 50% compared to the base case in 2040. Nickel demand would decrease by 5% in 2040 compared to the base case.

Accelerated adoption of lithium metal anodes and ASSBs would increase lithium demand by 22% in 2040 compared to the base case, while also significantly reducing demand for graphite (-44%) and silicon (-33%).

A rapid transition to silicon-rich anodes nearly triples silicon demand in 2030 compared to the base case, while graphite demand declines slightly (-6%). By 2040, silicon demand only increases by 70%, due to the increased adoption of silicon-rich anodes even in the base case.

IEA report

That means there's a growing demand for mined goods, which means more mines and more extraction, but that doesn't necessarily mean more people are willing to go mine. Labor shortages, combined with stricter safety regulations and the growing threat of costly lawsuits due to workplace injuries, will effectively lead to more automation in the sector.

The remote location of mines and the repetitive nature of the work are also driving automation: “Mine vehicles typically travel the same routes or perform the same movements throughout the day, such as digging and loading materials onto vehicles,” writes Sarah Jensen. Power & Motion“This helps with the design of autonomous systems because there are known patterns that can be more easily integrated compared to the different drive cycles of road vehicles.”

Big players with big money

So it's no surprise that the race is on to bring practical electric, autonomous heavy mining equipment to market. At last year's CES, electric autonomous machines from Hyundai, Bobcat, Volvo CE and Caterpillar garnered a lot of attention with their innovative concepts (above), and for good reason.

IDTechEx estimates that a single 150-tonne haul truck can use $850,000 worth of fuel in a year. Meanwhile, large electric haul trucks, like this 240-tonne unit from Caterpillar, can operate without significant recharging costs in certain use cases that make heavy use of regenerative braking. In that respect, the reduced maintenance and downtime of BEVs compared to diesel vehicles further adds to the TCO benefits.

Taking all this into account, Allied's 4.1% growth rate seems modest at best.

Source: Allied Market Research, IEA, Power Motion, and other sources are linked in the post.

FTC: We use automated affiliate links that generate revenue. more.