(Bloomberg) — Asian stocks were mixed as U.S. stocks extended their losing streak for the longest time since January.

Most Read Articles on Bloomberg

Japanese stocks fell from the start of trading, but Australian and South Korean stocks rose. Stock futures in Hong Kong are showing early losses, while similar contracts in China are rising. U.S. futures were little changed after the S&P 500 index fell for a fourth straight day on Wednesday, extending its decline by more than 4% from last week's all-time high.

Asian chipmakers such as Taiwan Semiconductor Manufacturing Co. and Tokyo Electron, which will report results later on Thursday, will be the focus of early trading. ASML Holding NV, Europe's most valuable tech company, said on Wednesday that orders for the first quarter were down and sales in China were likely to be hampered by U.S. export control measures. Nvidia Inc. led the losses among U.S. mega-cap stocks.

Tony Sycamore, a market analyst at IG Australia in Sydney, said ASML's results were “a bit of a warning shot ahead of some of the megatech stocks coming out next week”. “There may be a little bit of nervousness creeping into semiconductor stocks. If it involves exposure to semiconductors, it's going to be a pretty tough day.”

Meanwhile, Micron Technology, the largest U.S. maker of computer memory chips, is poised to win more than $6 billion in grants from the Commerce Department to fund domestic factory projects, according to people familiar with the matter. This is part of an effort to bring semiconductor production back to the U.S. mainland.

Investors are increasingly skeptical about how far U.S. stocks can rise after their strongest start since 2019, when they rose 10% in the first quarter. The decline comes even as U.S. data shows continued economic strength.

A day after Jerome Powell poured cold water on bets on interest rate cuts, the U.S. Treasury market saw strong buying, with the two-year bond yield falling further below 5% and a $13 billion sale of 20-year bonds drawing solid demand. Ta. Benchmark 10-year U.S. Treasury yields were stable in Asian trading.

“The U.S. central bank remains on track for two rate cuts this year, likely starting at its September meeting,” said Solita Marcelli, chief investment officer for the Americas at UBS Group Wealth Management. . “This means that the earnings outlook for high-quality bonds remains positive and attractive, and that recent losses in bonds are likely to be temporary.”

The dollar was little changed in Asia after falling for the first time in six days on Wednesday, as officials in Japan and South Korea continued to express concerns about the decline in their currencies. This year, the yen has depreciated by about 9% against the dollar, and the won has depreciated by about 7%.

Read more: Yellen admits Japan, South Korea are concerned about yen, won

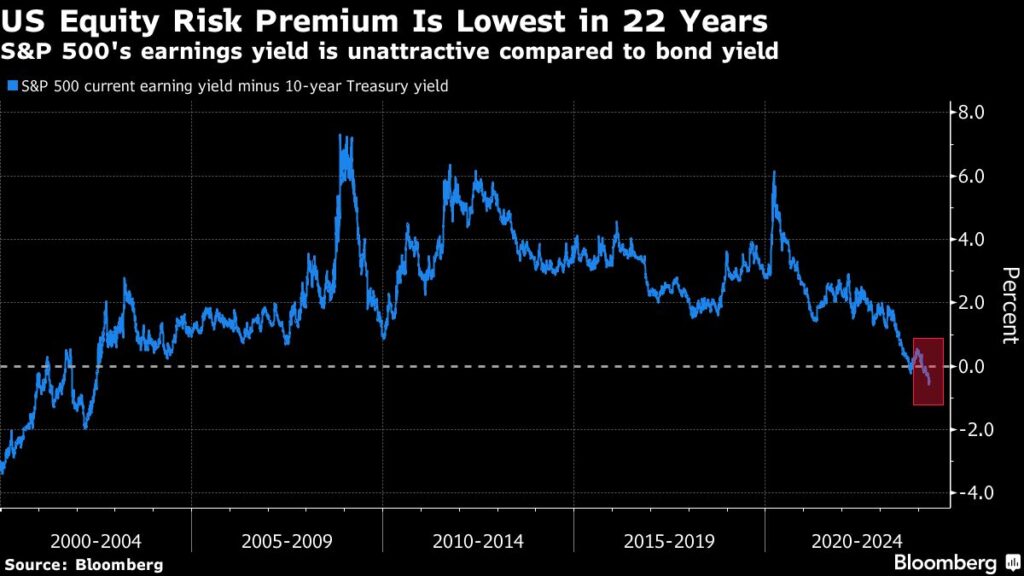

The equity risk premium for U.S. stocks — a measure of the difference in expected returns between stocks and bonds — is currently in deep negative territory, something that hasn't happened since the early 2000s.

This is not necessarily a negative indicator for the stock market, but it all depends on the business cycle. Lowering insurance premiums not only promises to boost future corporate profits, but can also be seen as a sign that a bubble is brewing.

HSBC strategists led by Max Kettner say stock market fundamentals and technical trends remain supportive, suggesting the recent decline is temporary.

“Real money investors have recently begun to take a more constructive stance on the stock, but sentiment and positioning are not raising any warning signals,” they write.

Elsewhere, oil sustained most of Wednesday's 3% decline, weighed down by weak Chinese industrial data and rising U.S. crude inventories, while gold edged higher.

This week's main events:

-

Taiwan Semiconductor's financial results, Thursday

-

US conference board leading index, number of existing home sales, number of new unemployment insurance claims, Thursday

-

Fed Director Michelle Bowman speaks Thursday

-

New York Fed President John Williams speaks Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

BOE Deputy Governor Dave Lumsden and ECB Board Member Joachim Nagel speak on Friday

-

Chicago Fed President Austan Goolsby speaks on Friday

The main developments in the market are:

stock

-

S&P 500 futures were little changed as of 9:03 a.m. Tokyo time.

-

Japan's TOPIX fell 0.3%

-

Australia's S&P/ASX 200 rose 0.2%

-

Hang Seng futures fell 0.5%.

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0666.

-

The Japanese yen remained almost unchanged at 154.36 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2450 yuan to the dollar.

-

The Australian dollar was almost unchanged at US$0.6436.

cryptocurrency

-

Bitcoin rose 0.8% to $61,349.89

-

Ether rose 0.6% to $2,990.6

bond

-

The 10-year government bond yield was almost unchanged at 4.59%.

-

Japan's 10-year bond yield remains almost unchanged at 0.875%

-

Australian 10-year bond yields fell 5 basis points to 4.33%.

merchandise

-

West Texas Intermediate crude rose 0.1% to $82.80 a barrel.

-

Spot gold rose 0.3% to $2,369.07 per ounce.

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP