(Bloomberg) — Asian stocks are expected to open flat to lower after a weak start to earnings reports from the “Magnificent Seven” big technology companies.

Most read articles on Bloomberg

Japanese and Hong Kong shares fell on Wednesday, while Australian shares were little changed. The Taipei stock exchange is closed due to a typhoon.

Investors had been banking on tech gains to sustain the bull market that has driven U.S. and global stocks to record highs. But that didn't happen as Alphabet Inc.'s shares slid despite better-than-expected earnings and its CEO suggested patience is needed to see tangible results from its investments in artificial intelligence. Electric-car maker Tesla Inc.'s shares tumbled 7% after it reported weaker-than-expected profits and postponed its robotaxi event until October.

The Magnificent Seven's early earnings outlook is unimpressive

A $290 billion exchange-traded fund tracking the Nasdaq 100 index fell in late trading on Tuesday after the Nasdaq 100 and S&P 500 indexes both fell in regular trading on Tuesday.

“Given the high earnings expectations of the Magnificent Seven, these companies will have a lot to prove,” said Anthony Sagrimbene at Ameriprise. “At the same time, their prospects will likely be heavily scrutinized relative to their inflated valuations.”

In Asia, Typhoon Gami was approaching Taiwan bringing strong winds and heavy rains, forcing Taipei to suspend its $2.4 trillion stock market. No trading of securities, currencies or bonds will take place in Taiwan on Wednesday, the Taiwan exchange said.

Investors are also focusing on China, where economic problems and geopolitical risks have caused markets to lose momentum. The domestic stock benchmark CSI300 index closed down 2.1% on Tuesday, its biggest drop in six months, as the lack of major policy support after the Third Plenary Session of the Central Committee intensified bearish sentiment.

In Japan, meanwhile, political frustration is growing over the central bank's cautious stance. The BOJ's ultra-low interest rates have kept the yen under downward pressure, and inflation continues to outpace the central bank's target and wage growth. Speaking a week before the bank meets to decide whether to raise interest rates, ruling party heavyweight Motegi Toshimitsu said the bank should signal more clearly its intention to normalize monetary policy.

Strong results on Wall Street will provide a much-needed boost to stocks after a strong first half of the year. The market is under pressure as it heads into a seasonal slowdown and the U.S. presidential election could add to volatility. But in addition to woes at big technology companies, United Parcel Service Inc. suffered its biggest selloff on record after missing profits.

The Big Five U.S. technology companies are facing a tougher earnings cycle than last year's stellar earnings cycle, with the group's profits expected to rise 29% in the second quarter from a year earlier, according to data compiled by Bloomberg Intelligence.

While still strong, that's down from the past three quarters, and how stocks will react to earnings remains one of the biggest uncertainties for investors.

“The fact that these stocks were in a weak spot ahead of their earnings releases isn't necessarily a bad thing, as it just means the hurdle for stocks to rise in the run-up to the earnings release may be unrealistically high,” Bespoke Investment Group said. “It doesn't take a gymnast to know that the lower the hurdle, the easier it is to overcome it.”

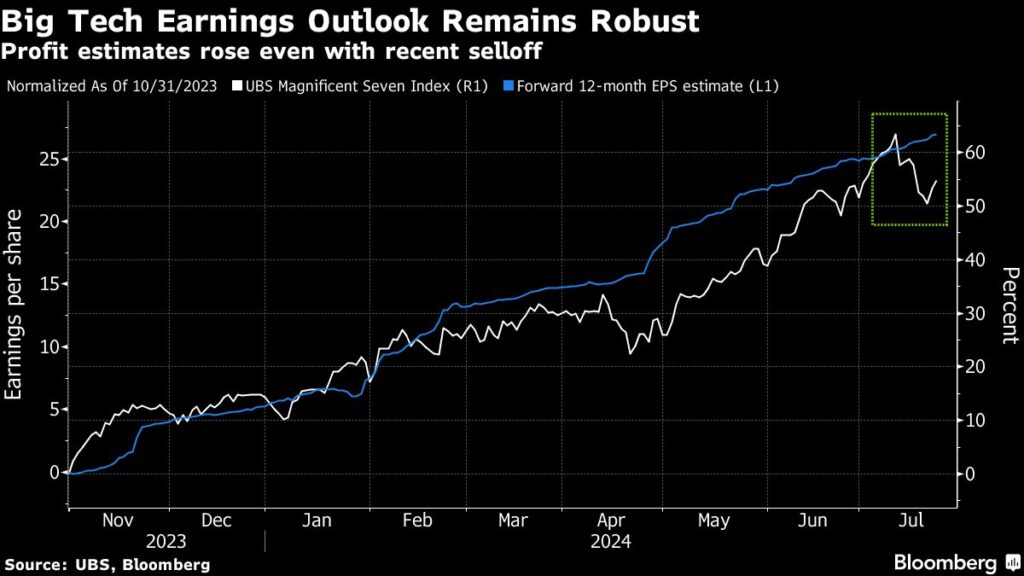

Investors are worried about a continued sell-off in big U.S. tech shares, but Barclays strategists say strong earnings prospects mean the stocks remain attractive after the recent sell-off.

Venu Krishna's team raised its year-end target for the S&P 500 index to 5,600 points from 5,300 points, citing strong earnings prospects for big technology companies.

“While our valuation assumptions for large technology companies are high, growth-adjusted multiples are reasonable and we expect the group to deliver earnings commensurate with its valuation,” they said.

U.S. two-year Treasury yields fell after a $69 billion auction confirmed market expectations of a rate cut. Crude oil tumbled on algorithmic selling and a summer liquidity slump.

Investors may also continue to analyze the impact of President Joe Biden's suspension of his re-election campaign.

“The impact on sectors associated with Republican or Democratic dominance on these policy issues will likely be different in the future compared to the past,” said Lauren Goodwin, economist and chief market strategist at New York Life Investments. “For most investors, the most powerful strategy in an election year is simple: continue to diversify rather than chase tactical bets, especially before we know the likelihood of actual policy changes.”

Company Highlights:

-

Visa Inc. reported quarterly earnings that fell short of Wall Street expectations, a rare development for the world's largest payments network.

-

Soft drinks giant Coca-Cola raised its full-year outlook as higher prices helped improve business performance.

-

General Motors Co.'s profits rose 60 percent from a year ago, far beating Wall Street expectations as demand for gasoline-powered trucks in the United States strengthened.

-

LVMH's sales growth slowed last quarter as the wealthy curbed spending on pricey Louis Vuitton handbags and Christian Dior couture.

Major events this week:

-

Canada interest rate decision Wednesday

-

U.S. New Home Sales, S&P Global PMI, Wednesday

-

IBM, Deutsche Bank Earnings Wednesday

-

German IFO Business Environment, Thursday

-

US GDP, initial jobless claims, durable goods, Thursday

-

US Personal Income, PCE, Consumer Sentiment Friday

Some of the key market developments:

stock

-

The S&P 500 fell 0.2%, while futures were down 0.4% as of 7:37 a.m. Tokyo time.

-

The Nasdaq 100 fell 0.3%.

-

The Dow Jones Industrial Average fell 0.1%.

-

The MSCI World Index was little changed

-

Bloomberg Magnificent 7 Total Return Index little changed

-

The Russell 2000 Index rose 1%.

-

Hang Seng futures fell 0.2%

-

S&P/ASX 200 futures up 0.1%

currency

-

The Bloomberg Dollar Spot Index was little changed.

-

The euro was little changed at $1.0851

-

The British pound fell 0.2% to $1.2903.

-

The Japanese yen was little changed at 155.62 yen to the dollar.

-

The offshore yuan was little changed at 7.2892 yuan per dollar.

Cryptocurrency

-

Bitcoin rose 0.1% to $65,946.70.

-

Ether little changed at $3,483.60

Bonds

-

The yield on the 10-year Treasury note was little changed at 4.25%.

-

Australia's 10-year government bond yield rose 4 basis points to 4.35%.

-

German 10-year government bond yields fell 6 basis points to 2.44%.

-

UK 10-year government bond yields fell 4 basis points to 4.12%.

merchandise

This story was produced with assistance from Bloomberg Automation.

Most read articles on Bloomberg Businessweek

©2024 Bloomberg LP