The Avi-Tech Holdings (SGX:1R6) share price has risen by 10% over the past three months. However, since a company's long term financial performance will ultimately determine market outcomes, we decided to focus on the company's weak fundamentals in this article. Specifically, we decided to look at Avi-Tech Holdings' ROE in this article.

ROE or return on equity is a tool that helps assess how effectively a company can generate profits on the investment it received from its shareholders. In other words, it is a profitability ratio that measures the return on capital provided by the company's shareholders.

View our latest analysis for Avi-Tech Holdings

How do you calculate return on equity?

Return on equity can be calculated using the following formula:

Return on Equity = Net Income (from continuing operations) / Shareholders' Equity

So, based on the above formula, Avi-Tech Holdings's ROE is:

7.7% = S$4.1m ÷ S$53m (Based on the trailing twelve months to December 2023).

“Return” refers to annual profit, which means that for every S$1 of shareholders' capital, the company generated S$0.08 in profit.

What is the relationship between ROE and profit growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits a company reinvests or “retains”, we are able to evaluate a company's future profit-generating ability. Assuming all else is equal, companies with both a higher return on equity and retained profits typically have higher growth rates compared to companies that don't have the same characteristics.

Abitec Holdings' Revenue Growth and 7.7% ROE

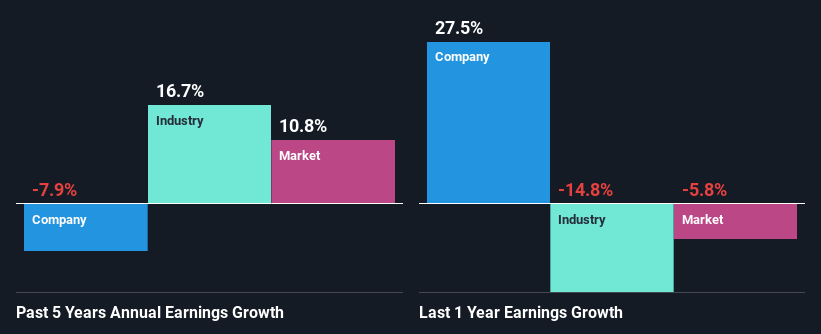

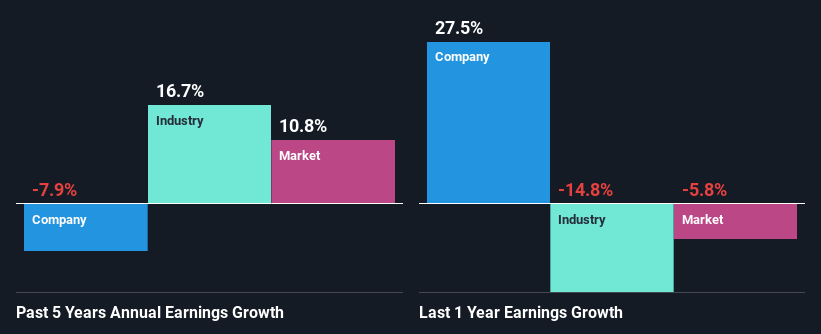

At first glance, Avi-Tech Holdings' ROE doesn't look very promising. However, on closer inspection, we see that the company's ROE is roughly in line with the industry average of 8.3%. However, Avi-Tech Holdings' net income has fallen by 7.9% over the past five years. Keep in mind that the company's ROE is a bit low, which may explain the shrinking revenue growth.

However, when we compare Avi-Tech Holdings' growth with the industry, we find that the company's revenue has been shrinking while the industry has experienced revenue growth of 17% in the same period, which is quite worrying.

Earnings growth is a big driver of stock valuation. Investors need to see if the expected growth or decline in earnings, in either case, is priced into the price. Doing so helps them determine if the stock's future is promising or ominous. Is Avi-Tech Holdings fairly valued relative to other companies? The following three valuation metrics may help you decide:

Is Avi-Tech Holdings reinvesting its profits efficiently?

Avi-Tech Holdings's declining earnings are not surprising given that the company is spending most of its profits to pay dividends, judging by its three-year median dividend payout ratio of 80% (or a retention ratio of 20%). With so little being reinvested in the business, earnings growth is clearly low to nonexistent. Our risks dashboard should show you the three risks we've identified for Avi-Tech Holdings.

Furthermore, Abitec Holdings has been paying dividends for nine years, suggesting that management is willing to continue paying the dividend despite declining earnings.

summary

Overall, one should be very cautious before making any decisions regarding Avi-Tech Holdings. With a low ROE and little reinvestment in the business, the company's earnings growth is disappointing. We've only briefly looked at the company's growth data so far. To learn more about Avi-Tech Holdings' past earnings growth, check out our visualization of historical earnings, revenue and cash flow.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com