A number of global and regional private equity firms, including TPG, PAG and Hillhouse Investments, have confirmed their interest in joining as investors, two people said. .

The sources, speaking on condition of anonymity because the information is confidential, said talks to take Li-Ning private are in the early stages and details have not yet been finalized. Li Ning made her Hong Kong debut in 2004.

Following the Reuters report on Tuesday, the company's shares rose as much as 20% to HK$24.55, the highest since November.

“We have not received any information regarding this matter at this time,” Beijing-based Li Ning said in a response to Reuters.

Lee did not immediately respond to a request for comment sent through the company.

TPG, PAG and Hillhouse declined to comment.

Stock markets in Hong Kong and mainland China have been depressed over the past year due to a slowing Chinese economy, lack of strong economic stimulus and geopolitical tensions.

Hong Kong's Hang Seng Index fell 14% in 2023, while China's benchmark CSI300 index fell 11%.

Mr. Li's company feels undervalued in Hong Kong and would seek a significant premium over the current share price in any deal, two people familiar with the matter said.

One of them added that he had no imminent plans to relist the company on the mainland.

Li Ning & Co. was the worst-performing blue-chip stock on the Hong Kong Stock Exchange over the past year, dropping nearly 70% as of Monday, according to LSEG data. In comparison, its main rival, Anta Sports, saw a 25% decline.

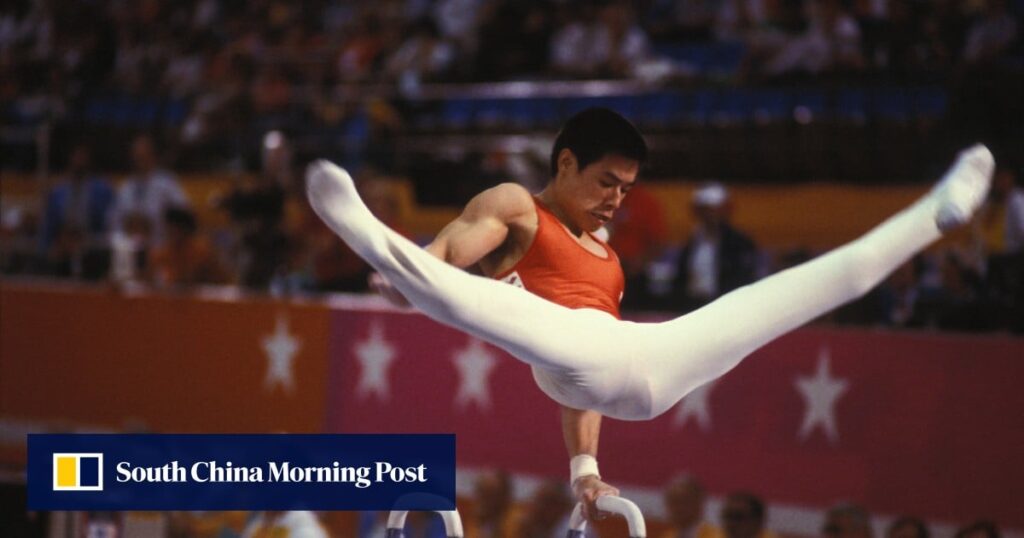

Mr. Li won six of the seven gold medals at the 1982 World Cup Gymnastics Games and was considered China's “prince of gymnastics,” and continued to win six medals at the 1984 Los Angeles Olympics.

In December, Li Ning announced that it would acquire Hong Kong commercial and retail properties from Henderson Land for HK$2.21 billion and establish its headquarters in the city, sending its shares to a three-and-a-half year low. announcement.

At the time, Mr. Lee also announced plans to buy back up to HK$3 billion of its own shares from the open market within the next six months, the first buyback in the company's history, according to Citigroup analysts.

In the announcement, the company's board said it believes the current stock price is “below its actual underlying value.”

A number of Hong Kong-listed companies, including French skin care company L'Occitane and American luggage maker Samsonite, have also recently held talks with advisers and investors about possible going private, another source said. .

Samsonite declined to comment. L'Occitane did not respond to a request for comment.

But bankers say take-private deals remain difficult for management teams and private equity investors because financing is costly in the current interest rate environment and fair valuations are difficult to achieve without a stable market. I warned him that it would remain the same.

“The number of inquiries is definitely increasing. [about take-private deals] “Since the end of last year,” said Samson Lo, co-head of Asia Pacific M&A at UBS.

“While the valuation gap is narrowing, there is still a gap. Financing remains a major challenge for large deals.”