To justify the effort of picking individual stocks, it's worth striving to beat returns from market index funds. However, results among individual stocks in any portfolio are mixed.Therefore, it is not to blame in the long run Adval Tech Holding AG (VTX:ADVN) shareholders have questioned their ownership decisions, and the share price has fallen 49% in five years.

It's worth assessing whether the company's economic performance is keeping pace with these overwhelming shareholder returns, or if there are any discrepancies between the two. So let's just do that.

Check out our latest analysis for Adval Tech Holding.

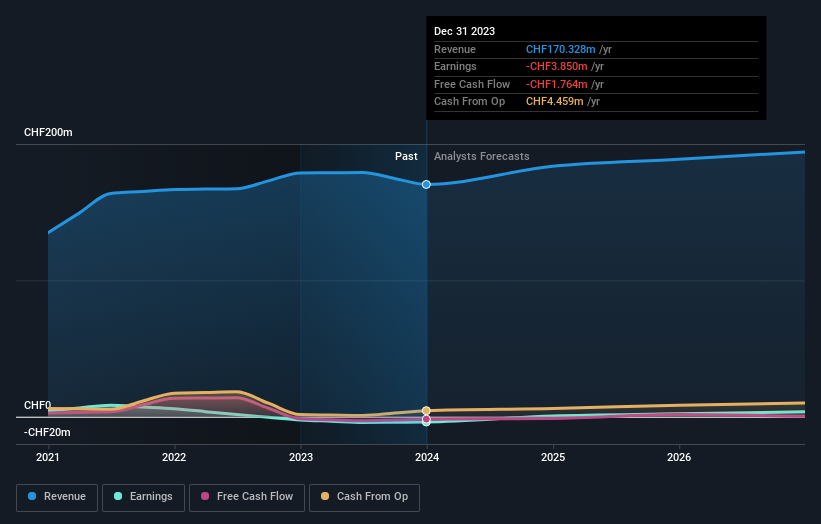

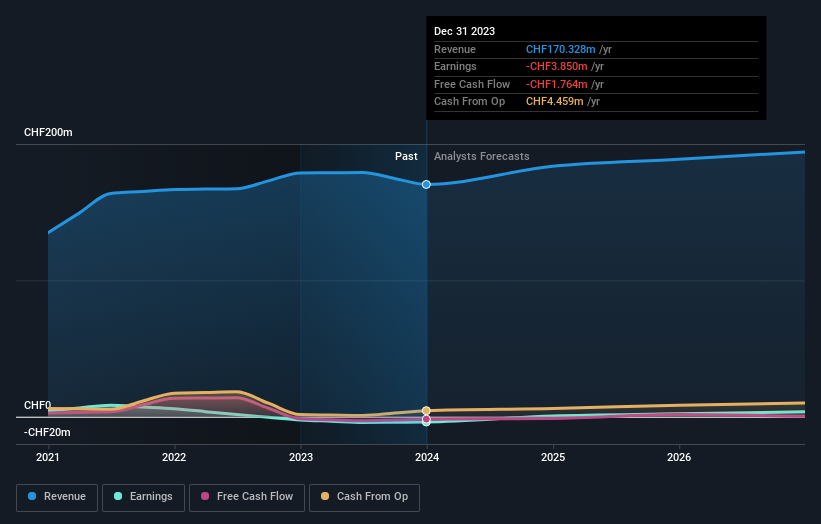

Adval Tech Holding didn't make a profit in the last twelve months. You're unlikely to see a strong correlation between share price and earnings per share (EPS). The next best option is probably revenue. Generally speaking, unprofitable companies are expected to have steady revenue growth every year. It's hard to be confident that a company is sustainable when its revenue growth is modest and it doesn't make any profits.

Over the past five years, Adval Tech Holding's revenue has grown by 0.1% per year. This is not surprising given the losses incurred. The 8% drop in share price isn't particularly surprising given the slowdown in growth. The important question is whether the company can reach profitability without any problems and even go beyond that. It might be worth putting it on your watchlist and revisiting it once you get your first profit.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how this balance sheet has strengthened (or weakened) over time. free Interactive graphics.

What about total shareholder return (TSR)?

Investors should note that there is a difference between Adval Tech Holding's total shareholder return (TSR) and share price change discussed above. The TSR seeks to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Adval Tech Holding's TSR was a loss of 46% over 5 years. Since it pays dividends, the stock price return wasn't too bad.

different perspective

While the broader market was down around 0.9% in the twelve months, Adval Tech Holding shareholders fared even worse, down 17%. However, it is also possible that the stock price is simply being affected by broader market fluctuations. It might be worth looking at the basics in case a good opportunity presents itself. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the 8% annualized loss over the past five years. In general, long-term stock price weakness can be a bad sign, but contrarian investors may want to research the stock in hopes of a turnaround. I think it's very interesting to look at stock price over the long term as an indicator of business performance. But to really gain insight, you need to consider other information as well. For example, consider the ever-present fear of investment risk. We've identified 2 warning signs for you If you are considering partnering with Adval Tech Holding, understanding them should be part of your investment process.

If you're like me, you will. do not have I want to miss this free A list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.