For some speculators, the excitement of investing in a company that has the potential to reverse its fortunes is a big draw, so even a company with no revenue or profits and an underperforming track record can still manage to find investors. I can. Unfortunately, these high-risk investments often have little chance of return, and many investors pay a price to learn their lesson. Because loss-making companies are always in a race against time to achieve financial sustainability, investors in these companies may be taking on more risk than necessary.

Despite the era of blue-sky investing in tech stocks, many investors still employ traditional strategies.Buy shares in profitable companies such as eurotech holdings (NASDAQ:CLWT). This doesn't necessarily indicate whether it's undervalued or not, but the profitability of the business is enough to justify some valuation, especially if it's growing.

Check out our latest analysis for Euro Tech Holdings.

How fast is Eurotech Holdings growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so ultimately we expect stock prices to follow the results of earnings per share (EPS). Therefore, there are many investors who want to buy stocks in companies that are growing EPS. Impressively, Eurotech Holdings has grown its EPS at 34% compounded per year over the past three years. As a general rule, if a company can maintain it; that Shareholders will be all smiles if they see some kind of growth.

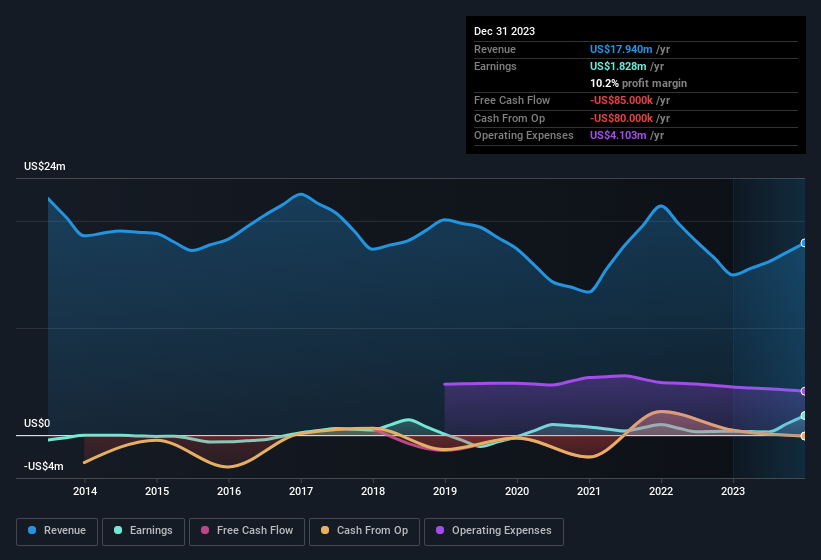

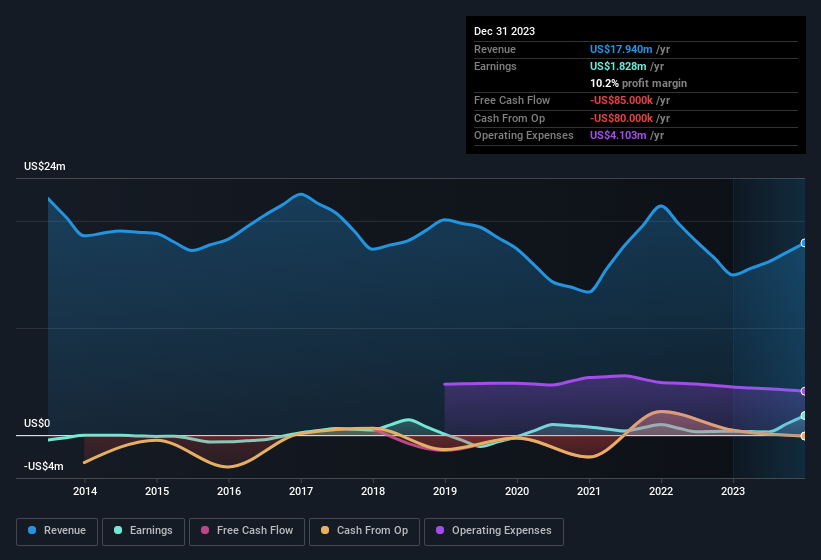

Revenue growth is a good indicator that growth is sustainable and, when combined with high earnings before interest and tax (EBIT) margins, can help a company maintain a competitive advantage in the market. This is an excellent method. Eurotech Holdings steadily grew its sales last year, but at the same time its EBIT margin declined. Therefore, this top-line growth should reward shareholders if EBIT margins can stabilize.

You can see the company's revenue and profit growth trends in the graph below. Click on the image for more detailed information.

Euro Tech Holdings isn't exactly a huge company, considering its market capitalization of US$13m. Therefore, it is very important to check the strength of the balance sheet.

Are Eurotech Holdings insiders in line with all shareholders?

Many consider high insider ownership to be a strong sign of alignment between company leaders and public shareholders. So, as you might expect, it's certainly interesting to see that Euro Tech Holdings insiders own a significant number of shares. In fact, company insiders with a 56% stake are in control and have deep pockets in this venture. This should be seen as a good thing, because it means insiders have a personal interest in delivering the best outcome for shareholders. Of course, Euro Tech Holdings is a very small company, with a market capitalization of just US$13m. So despite their large proportionate ownership, insiders only own US$7m worth of shares. This isn't a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's always good to see strong belief in a company from insiders through significant investment, but it's also important for shareholders to ask whether management's remuneration policy is reasonable. A quick analysis of CEO compensation shows that this is the case. The median total compensation for CEOs at companies similar to Eurotech Holdings, with a market capitalization of less than USD 200 million, is approximately USD 675,000.

The CEO of Eurotech Holdings received total compensation of only US$300,000 for the year ending December 2022. This appears to be a modest remuneration and may suggest some respect for shareholder interests. While CEO pay levels shouldn't be the biggest factor in determining how a company is viewed, modest pay is a positive, as it suggests the board has shareholder interests in mind. It is also a sign of a culture of integrity in a broader sense.

Is Eurotech Holdings worth watching?

For growth investors, Eurotech Holdings' earnings growth is a beacon. If you need more convincing than EPS growth, don't forget the reasonable compensation and high insider ownership. This may only be a brief overview, but the important point is that Eurohe Tech Holdings is worth paying attention to. I don't really want it to rain on the parade, but it did rain. 2 warning signs for Eurotech Holdings What you need to be careful about.

Eurotech Holdings does look good, but if insiders have been buying up shares, it could become more attractive to more investors. If you want to know which companies have insider buying, check out our curated selection of companies that not only boast strong growth, but also have recent insider buying.

Please note that insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Interested in its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.