primeimages/iStock (via Getty Images)

Goldman Sachs' head of hedge fund coverage says investors should continue to focus on mega-cap tech stocks amid expectations for overall market volatility in the near term.

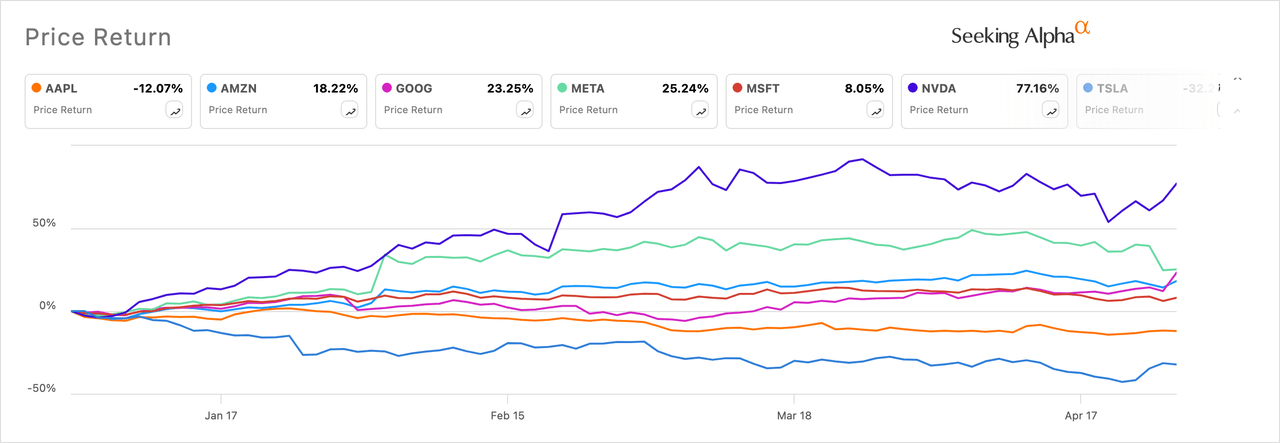

Among the Magnificent 7, Apple (AAPL), Amazon (AMZN)), alphabet (google) (Google), Microsoft (MSFT), NVIDIA (NVDA) and Tesla (TSLA) ended the week on the rise. Meta (meta) fell nearly 8% on concerns about guidance.

“While certainly not homogeneous, this group continues to do what it does best,” Tony Pasquariello wrote in a memo. “TSLA clearly beat expectations with a notable improvement in gross margin; META was hit hard with missed guidance and higher costs in Q2 (again, Want to compete with $35-40 billion in capex?) MSFT was a clean beat with strength in the best places…GOOG was also a clean beat with a pleasing return on capital story. ($70 billion in incremental share buybacks and dividends).”

“While tech company earnings make it clear that we shouldn't limit our imaginations, the overall upward convexity of the market will continue for some time, especially as markets grapple with the 'last mile' issue of inflation. My gut feeling is that it's limited,” Pasquariello said.

“I am S&P (NYSEARCA:Spy) (IVV) (VOO) continues to chop in the next phase of the game, where the highest returns are made at the single stock/sector/theme level of the stack (in which the (Please) is a US mega-cap tech),” he added.

Pasqualiello said he continues to favor the US market over other markets in the world, large caps over small caps (IWM), high quality over low quality, and cyclicals over defensive stocks. “There is a blatant bias against them,” he said.