key insights

-

Olympic Steel will hold its annual general meeting on May 3rd

-

CEO Rick Malabito's total compensation includes a salary of $735,000

-

Total compensation is in line with industry average

-

Over the past three years, Olympic Steel's EPS grew by 5.5%, and its total shareholder return over the past three years was 136%.

performance at Olympic Steel Co., Ltd. (NASDAQ:ZEUS) has been doing pretty well, and CEO Rick Marabito has done a good job of steering the company in the right direction. Shareholders will keep this in mind when voting on company resolutions, including executive remuneration, at the general meeting on May 3. Here are some examples of why we think CEO compensation is fair.

Check out our latest analysis for Olympic Steel.

How does Rick Marabito's total compensation compare to his peers?

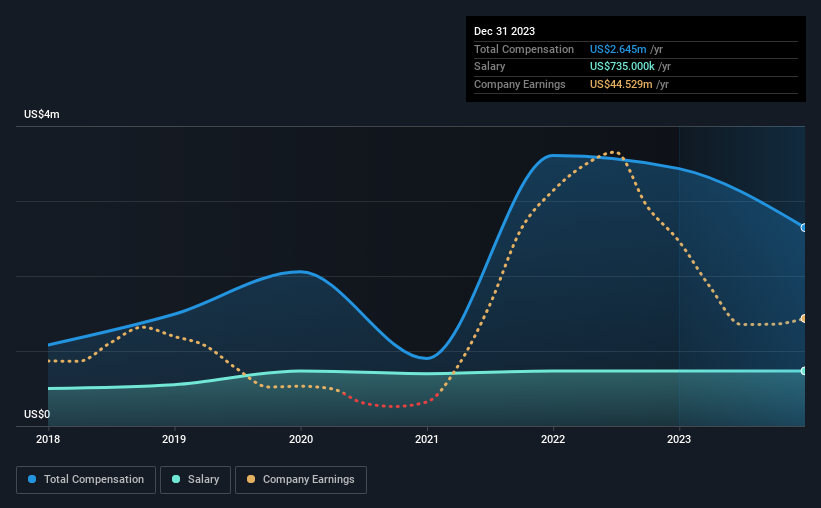

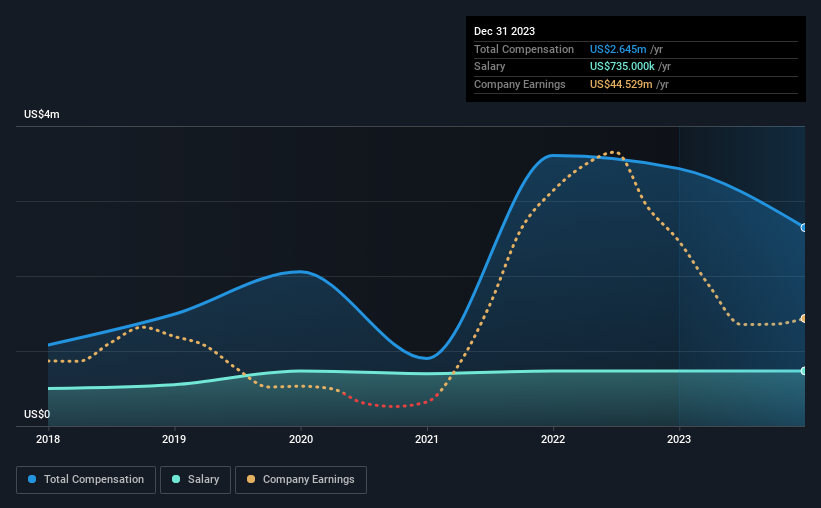

According to our data, Olympic Steel has a market capitalization of US$742m, and reports total annual CEO compensation of US$2.6m to December 2023. Notably, this is down 23% year over year. We think total compensation is more important, but our data shows that CEO salaries are lower, at US$735k.

Compared to other companies in the US Metal Mining industry with market capitalizations ranging from US$400m to US$1.6b, the median reported total CEO compensation was US$2.6m. From this, we can see that Rick Marabito's salary is about the median salary for CEOs in the industry. Additionally, Rick Malabito also holds US$2.9 million worth of Olympic Steel shares directly in his own name, revealing that they have a significant personal stake in the company.

|

component |

2023 |

2022 |

Percentage (2023) |

|

salary |

$735,000 |

$735,000 |

28% |

|

other |

1.9 million USD |

2.7 million USD |

72% |

|

Total compensation |

2.6 million USD |

3.4 million USD |

100% |

In terms of industry, salaries accounted for approximately 29% of total compensation and other compensation accounted for 71% of the pie among all companies analyzed. Olympic Steel roughly mirrors the industry average when it comes to salary as a percentage of total compensation. It's important to note that the trend toward non-salary compensation suggests that total compensation is tied to company performance.

Growth of Olympic Steel

Over the past three years, Olympic Steel, Inc.'s earnings per share (EPS) have grown at 5.5% per year. Revenue fell 16% last year.

While the lack of revenue growth over the last year isn't ideal, we'd argue that the slight improvement in EPS is good. In conclusion, we can't yet form a strong opinion on the business performance. But it's worth seeing. Past performance can sometimes be a good indicator of what's coming next, but if you'd like to take a peek into a company's future, this might interest you. free Visualize analyst forecasts.

Was Olympic Steel a good investment?

We think a total shareholder return of 136% over three years would make most Olympic Steel, Inc. shareholders smile. So they may not be concerned at all if their CEO's compensation is higher than normal for similarly sized companies.

As conclusion…

Given the company's reasonable overall performance, CEO compensation policy may not be a central focus for shareholders at the next general meeting. Despite the pleasing results, we believe that any proposed increase in CEO pay will be considered on a case-by-case basis and will be tied to performance results.

As well as looking at other aspects of the business, you can learn a lot about a company by examining its CEO compensation trends. Our research revealed that Two warning signs for Olympic Steel One of them cannot be ignored.

If you're looking to switch gears from Olympic Steel and want a healthy balance sheet and premium returns, this is the one for you. free A great place to start looking is our list of high-yield, low-debt companies.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.