Like many things in financial markets, the connection between commodities and the broader economy and global stock markets is a bit of a mystery.

As an example, central banks are commonly understood to raise interest rates to control inflation. But what is less understood is that interest rate hikes only affect our spending, the so-called “demand-pull inflation” associated with manufactured goods, and not “cost-push inflation” associated with commodity prices and wages. This means that it has almost no effect.

Central banks cannot control commodity prices or their supply because raising interest rates does not increase short-term supply of goods or attract long-term commodity infrastructure investment.

Another relationship that is rarely made is between technology and goods, or new school and old school. The internet, the cloud, artificial intelligence (AI) and the bits of picks, shovels and drills. But the relationship is strong and getting stronger, and could be a key factor in the extension of the current commodity cycle that began in 2020, a cycle that typically lasts 10 years.

The relationship between commodities and the current technology boom and AI is being driven by demand for data centers, computer chips, and electric vehicles (EVs). For each of these technologies to grow, the demand for the product will be enormous.

Data center, power, AI

In words that couldn't be written any better: “Like every technology known to humanity, AI has a dark side: high energy consumption.”

To say that AI is power-hungry is an understatement. AI requires more hardware and more powerful chips than regular computing. According to Schneider Electric SE, current global electricity demand is 4.3 gigawatts, and this figure could increase almost five times by 2028, with AI already consuming as much power as Bitcoin mining. Some people claim that there are.

According to Digiconomist, a single Nvidia Corp. DGX A100 server consumes as much electricity as several U.S. households combined, and cryptocurrencies, blockchain, and other technologies are also straining data centers. .

The demand for space comes as major data center operators such as Amazon.com Inc., Microsoft Corp., Alphabet Inc., Meta Platforms Inc., Oracle Corp. and TikTok owner ByteDance are experiencing power supply problems. It means “difficult to access electricity”. Let’s catch up,” Reuters recently stressed.

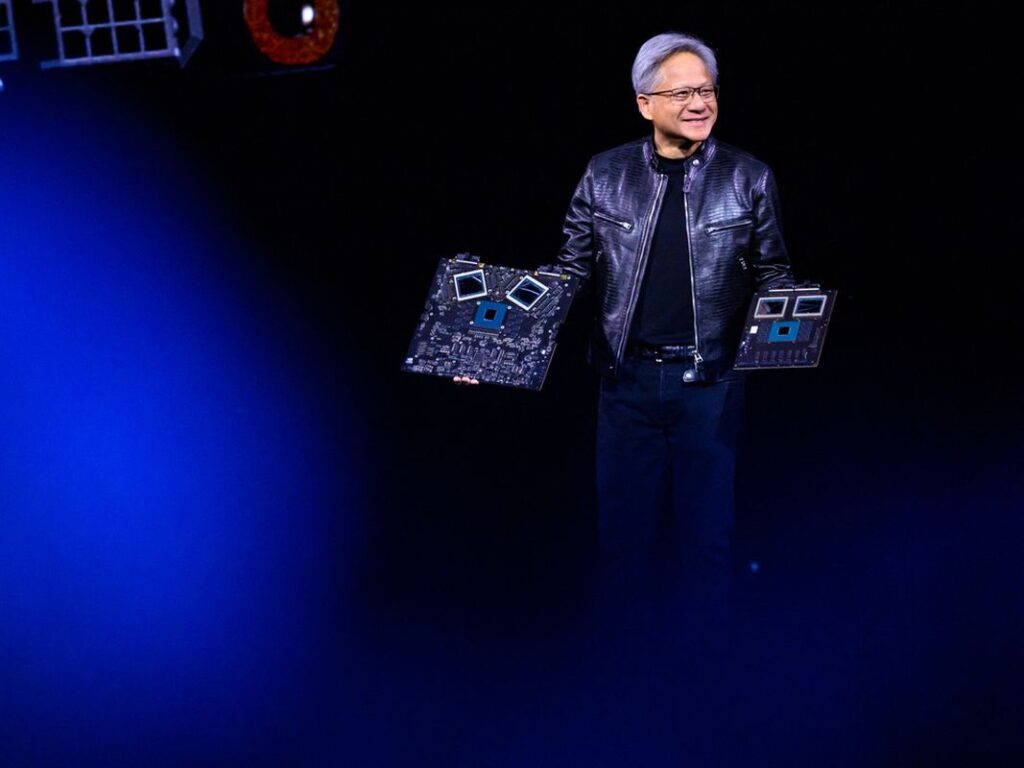

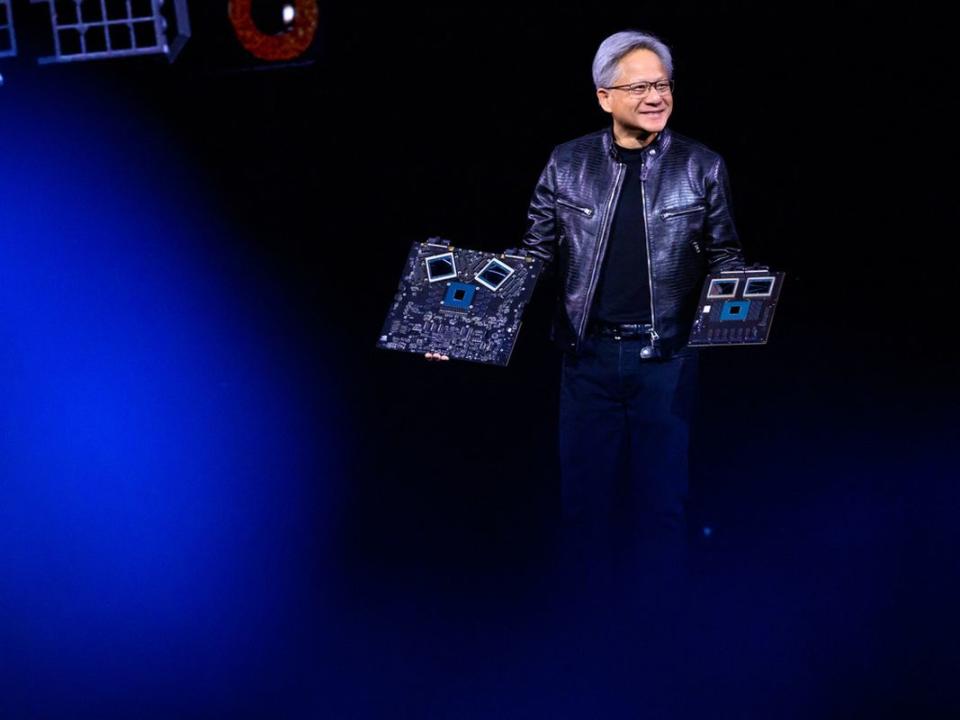

chips and AI

But the huge demand for computing power is not the only issue, as pressure on commodities is also increasing. There is a link between AI demand and precious metals. “Demand will increase for platinum alloys used in chip manufacturing, silver-palladium for high-power components, gold bonding wire for chips and memory packages, gold plating for printed circuit boards, and palladium plating for lead frames,” Reuters recently reported. Reported.

In addition to precious metals, base metals (industrial metals) are also important. It is generally known that the chip itself is silicon-based, but requires interconnections. These were usually made of aluminum, but cobalt or copper are now more common. Copper, often used as an economic barometer, appears to be just as important here. This highly conductive metal is used to connect components within integrated circuits, as well as to transfer power to the circuit itself.

As power demands from data centers continue to grow, we must recognize the importance of copper. The power grid relies heavily on copper for everything from the turbines that convert mechanical energy to electrical energy to the batteries, wires, and transformers that transport that power everywhere. According to a recent article, “Our modern world simply wouldn't function as well as it does without it.” by business insider.

Electric car

EVs are definitely part of the future. Adoption rates are debatable and appear to be geographically sensitive, but we recognize that there are trade-offs. As with everything in life and investing, there are trade-offs. As gasoline demand falls, electricity will come from elsewhere, but the components that drive this remain commodity-based. The International Energy Agency said a typical EV requires six times more mineral inputs than a conventional car.

According to a 2018 Deloitte report, if we turn away from fossil fuel consumption, there will be a significant impact on demand for lithium, cobalt, graphite for batteries, and less sexy metals such as zinc, nickel, and copper. There will be an impact. We have highlighted some of the expected results.

-

Most analysts expect global lithium demand to double or even triple by 2030.

-

Analysts predicted that demand for battery-grade graphite would triple by 2020.

-

Cobalt is facing a global supply shortage that could increase from 885 tonnes in 2018 to 5,340 tonnes in 2020.

-

EVs are expected to contain four times more copper than internal combustion engines.

-

Demand for battery-grade nickel is expected to increase by 50% by 2030.

That's quite a trade-off.

product cycle

The recent quiet in the commodity cycle following the Russian and Ukrainian invasions is just a pause. In addition to decarbonization, deglobalization, and demographic forces that didn't exist just a few years ago, we now have a huge new player in commodity demand: India.

The thrust of the commodity cycle is stronger than ever before in history, and new factors like the technology boom can awaken sleeping giants.

Timing financial markets is very difficult, but so are commodity markets. The reality is that commodities are the most diverse asset class. Cotton is different from crude oil, different from coffee, and different from canola. But all of these are important to our daily lives and economic realities.

Who cares how individual technologies will develop, how well EVs will be accepted, where AI will take us, whether data centers will be powered by cryptocurrencies, blockchain, and other factors? I don't even know what the product is, but I do know how the underlying product will play out. Even if it's at the breakfast table of a bunch of people employed by big tech, it's still needed in some way. After all, they have to eat.

Therefore, we recommend a diverse and wide-ranging product approach that is systematic and not tied to any particular market, while conducting disciplined risk management.

Perhaps the greatest trade and investment may actually be the difficult one: the technology to stimulate the next stage of demand for goods. In some ways it seems pretty obvious. Energy is required to power inputs such as data centers and metals. Reuters reported that companies are buying up suppliers to secure delivery times. “Big brands, including the investment arm of the IKEA Group, are following in the footsteps of car manufacturers by acquiring stakes in raw material and energy suppliers and seeking greater control over production.” “Over the past six months, companies have spent more than $4 billion investing in supply chains across industries such as food, batteries, chemicals, automotive, mining, waste and recycling.”

With supplies becoming increasingly tight and prices already rising, we think big tech companies could be the next big buyers of goods.

Tim Pickering is the Chief Investment Officer and Founder of Auspice Capital Advisors Ltd., Canada's largest active commodity and CTA fund manager. Auspice manages tactical long and long/short funds and his ETFs for retail and institutional investors in Canada and the United States.