The technology industry had an eventful first quarter. Nvidia (NVDA) stock continues to rise and rise, with highs, lows, and lows the first three months of the year, from the failed launch of Google's (GOOG, GOOGL) Gemini image generator to Apple's antitrust battle. And well, it was eventful. Even lower lows.

This quarter was also full of surprises. Meta Inc. (META) announced its first dividend payout and major stock buyback program, and Apple Inc. (AAPL) has decided to cancel its long-planned car program, making the company an automotive company, according to Bloomberg. It is said to have put an end to an initiative that was supposed to give the industry a sudden boost. industry.

When it comes to cars, EVs have taken over as sales have fallen off a cliff. The Federal Trade Commission (FTC) and the European Union's European Commission have begun to sniff out companies' AI investments.

Oh, did we mention that Congress has renewed efforts to ban TikTok in the United States? Yes, it's been a busy three months. And there are still nine more left. These are the good, bad, and ugly stories of Q1 2024.

good thing

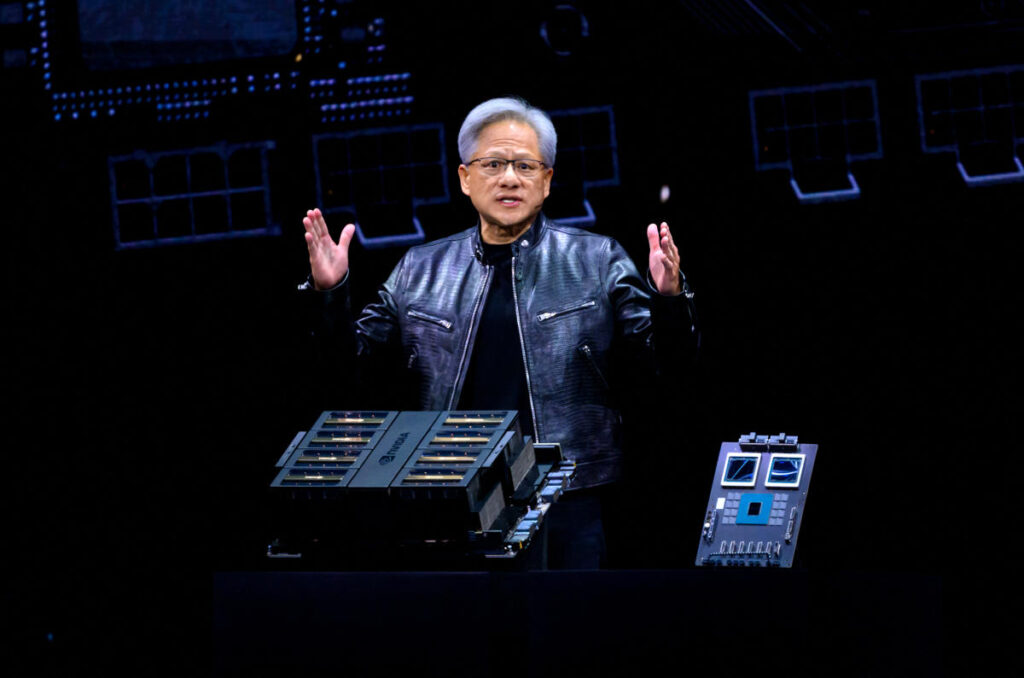

Let's start with some good news for the tech industry in Q1. First, the company that continues to dominate the AI conversation is Nvidia. In February, the company announced another monster quarter, beating Wall Street's expectations for revenue and profit and beating expected earnings for the current quarter.

Nvidia stock is up about 89% since the beginning of the year and 226% over the past 12 months. And in March, the company announced its new Blackwell AI processor architecture at his GTC conference. This conference felt more like a party than a developer event.

Also this quarter, Intel and the White House announced $8.5 billion in CHIPS Act funding to help chip makers build chip manufacturing and research and development facilities in factories across the United States.

Funding from the CHIPS Act is intended to boost the U.S. semiconductor industry, and Intel should benefit considerably from this funding as it begins manufacturing chips for third-party companies such as Microsoft. is.

Meanwhile, Apple has been in the news for ending its electric car project. According to Bloomberg, the company plans to move a number of its automotive employees into its AI division as Wall Street looks for signs that the iPhone maker is taking the generative AI trend seriously. Canceling the project also means Apple avoids a costly rollout at a time when sales of electric vehicles in the U.S. are sluggish.

Finally, in its first quarter earnings report, Meta announced that it would begin paying a quarterly dividend of $0.50 per share and authorized an additional $50 billion in stock repurchases. shares have soared 38% since the beginning of the year and 131% over the past 12 years. A few months.

bad person

The first quarter wasn't all good for the tech industry. Case in point, the FTC announced it would launch an investigation into investments by Alphabet, Amazon (AMZN), and Microsoft (MSFT) in generative AI companies such as Anthropic and OpenAI. Alphabet and Amazon have both invested billions in Anthropic, and Microsoft is pouring billions into OpenAI.

The FTC said the move “will help the agency improve enforcement officers' understanding of investments and partnerships formed between generative AI developers and cloud service providers.”

Result is? The FTC is watching Big Tech's efforts to grab as much of the AI market as possible, and whether those companies are gaining too much power.

The FTC isn't the only agency keeping an eye on tech companies. The European Union's competition watchdog, the European Commission (EC), is investigating Apple, Google and Meta's compliance with the European Union's Digital Markets Act (DMA).

The DMA is intended to force the opening up of services to prevent big technology companies from dominating certain markets. However, the EC is not convinced they are doing them a favor and is investigating whether they are complying.

Google continued to have hits during the quarter, even after the failed launch of its flagship AI-powered image generator Gemini. The company was forced to remove the app after users discovered it was creating images of multicultural Nazis, among other things.

Congress has joined in the movement, once again trying to take down TikTok, with the House passing a bill that would force parent company ByteDance to sell the social network or prevent it from being offered in Apple and Google's app stores. The Senate still needs to act on the bill, but First Amendment concerns may prevent any ban from taking hold.

ugly

But nothing is worse than these stories. At the top is the Department of Justice's antitrust lawsuit against Apple. The Department of Justice alleges that by maintaining a tight grip on its App Store and hardware, Apple is undercutting competition and harming developers and ultimately consumers.

According to the complaint, Apple locks out competitors from accessing features that compete with Apple Wallet and the Apple Watch. Apple disputes the claims, but the lawsuit could take years to resolve and could be a hindrance to Apple's future.

Tesla (TSLA) CEO Elon Musk has filed a lawsuit against OpenAI, the company he co-founded, alleging that the AI company has abandoned its original mission of developing AI technology that benefits humanity. woke up. Musk said that OpenAI is profit-oriented and is a subsidiary of Microsoft. OpenAI disputed Musk's claims, saying it was more or less upset that it had missed out on the company's explosive growth.

Finally, there is the electric vehicle market. EV sales are slowing in the U.S. as subsidies for some models dry up and sky-high interest rates make it difficult for consumers to buy them. Additionally, there are concerns about the cruising range, such as the possibility that the car will run out of power while driving. Conventional wisdom is that EVs will eventually become the predominant type of vehicle on the road over the next decade or so, but for now the sales surge seen over the past few years appears to be leveling off. It has become.

It's still early this year. Baseball season has just started, but my Mets are already in the basement. That is, a good story can be flipped and become a bad or ugly story, and vice versa. Next, let's move on to Q2.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter @Daniel Howley.

Click here for the latest technology business news, reviews, and helpful articles on technology and gadgets.

Read the latest financial and business news.ROM Yahoo Finance.