The stock market has been doing well lately. S&P 500 It's up 14% since the start of the year. Nasdaq Composite Index It's up 17%. Much of this performance is driven by the big, well-known technology companies that are in the news almost every day. But there are some great technology companies that don't get as much media coverage but are worth considering as investments.

Here are two great tech stocks to buy right now. Both companies are reporting strong earnings and are targeting big market opportunities. Let's take a closer look and see why.

Fortinet

Fortinet (Nasdaq: FTNT) Fortinet may not be the first cybersecurity company that comes to mind for most investors, but the company has performed well over the years. In fact, since its initial public offering (IPO) in 2009, the company's shares have risen more than 3,400%, far outperforming the S&P 500. But the past year has been a different story, with three sharp sell-offs following earnings reports that have caused the company's shares to fall 19%.

The company's stock price has been struggling recently because several key metrics have slowed. Year-over-year revenue growth has slowed for each of the past five quarters, and revenue (a proxy for future revenue) is following a similar trend. Combined, these two results have investors expecting continued volatility in the near term.

Despite the slowdown in sales, Fortinet was still able to stabilize profits and generate strong free cash flow. Additionally, the company expects to see stronger performance through the second half of 2024. Full-year revenue is expected to grow between 8% and 10%. By comparison, first-quarter revenue growth was just 7%. Billings are expected to grow between 0% and 3% for the full year after declining 6% in the first quarter.

Today's share price suggests that the market isn't yet ready to value these future performance results, but some argue that the company's current struggles will be short-lived, making it an attractive buying opportunity.

Procore

Some of the world's most successful companies got to where they are by disrupting incumbents in their industry. Procore (NYSE: PCOR) is disrupting the field of construction management. Today, construction professionals use a variety of legacy software products and other document creation systems, including spreadsheets and pen and paper. Procore offers products designed to bring all project stakeholders together on one platform to streamline the construction process.

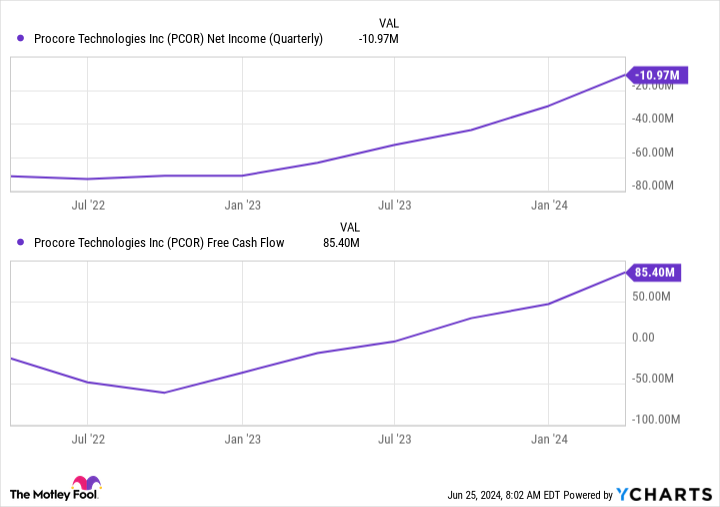

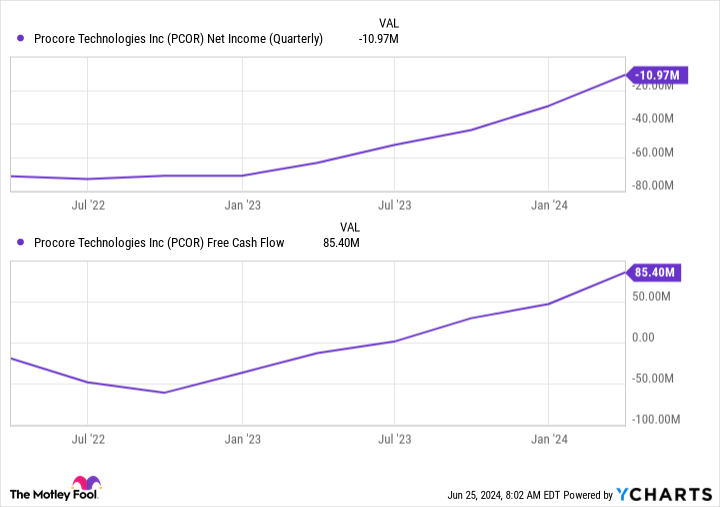

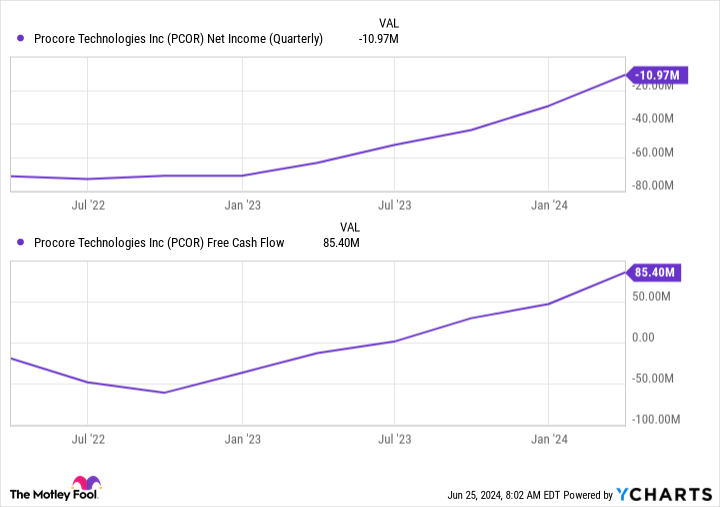

Although Procore only went public in 2021, it has consistently performed impressively and is improving over time. Revenues have grown steadily and the company is attracting more and more customers, including large ones that spend significant amounts of money on the company's platform each year. The company is still in its growth phase, so it is not yet profitable. However, it is making steady progress toward profitability. Consider the net loss and free cash flow improvement over the past two years:

PCOR Net Income (Quarterly) data from YCharts.

Procore also operates in a huge industry. The company predicts that global construction spending will reach $15 trillion in 2030. Even if that number is actually 50% lower, it's hard to deny that the size of the business opportunity for Procore is staggering. Steady growth over time should provide Procore with plenty of business, even if it ends up sharing the market opportunity with competitors.

The ultimate goal for investors

Both Fortinet and Procore have posted impressive financial performance in industries that represent a lot of future market opportunity. Neither has received much media attention so far, which may make them even more attractive as potential investments. Both companies offer attractive risk/reward opportunities for investors.

Should you invest $1,000 in Fortinet right now?

Before you buy Fortinet shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now… Fortinet wasn't among them. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $757,001.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of June 24, 2024

Jeff Santoro has invested in Fortinet and Procore Technologies. The Motley Fool has invested in and recommends Fortinet and Procore Technologies. The Motley Fool has a disclosure policy.

“2 Tech Stocks to Buy Now” was originally published by The Motley Fool.